This writeup reflects data from U.S.-only respondents. For a report on global conditions, see the SIOR Sentiment Survey at SIOR Sentiment Report.

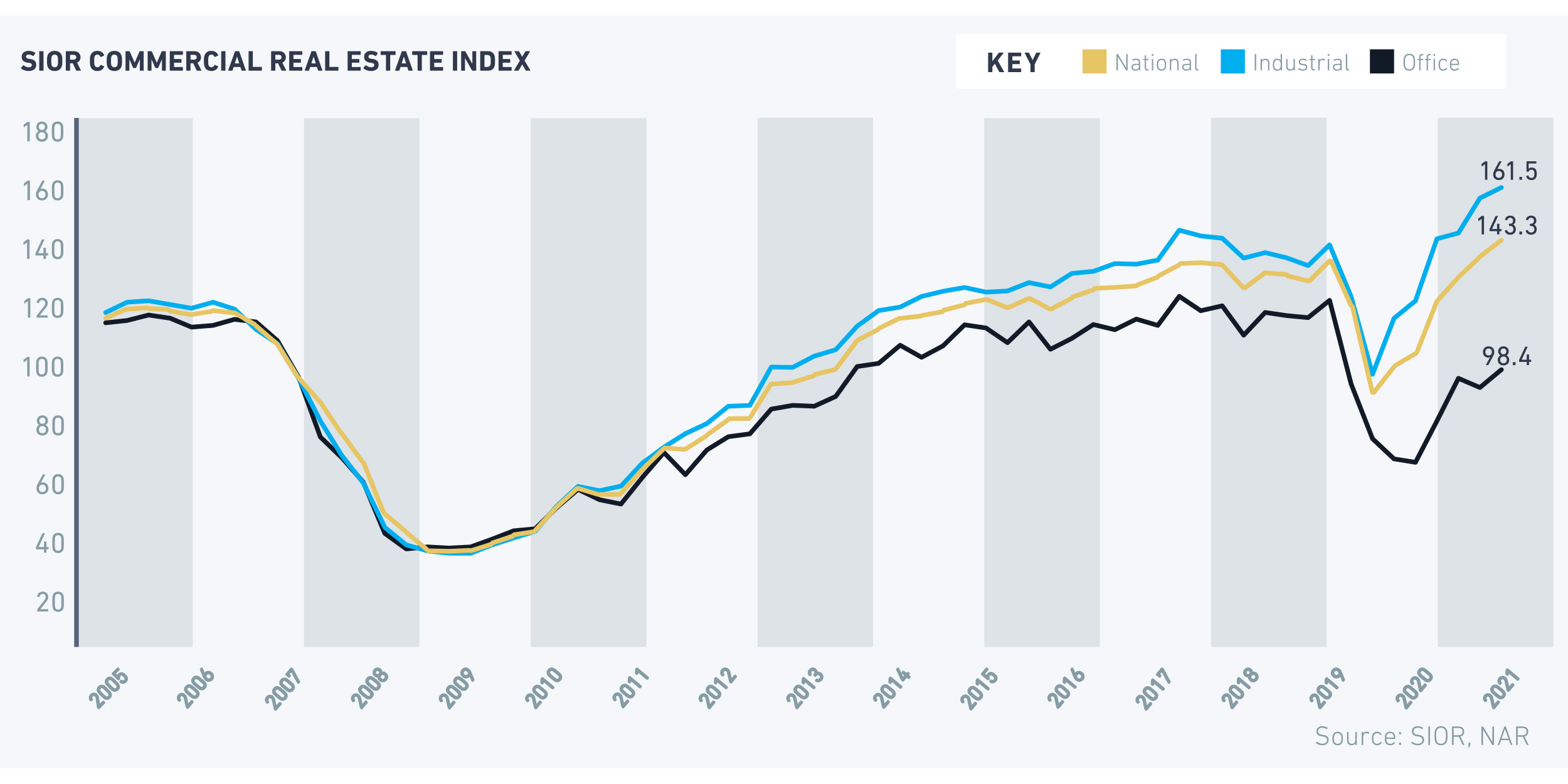

The demand for industrial and office real estate continued to pick up in the last quarter of 2021, with the year ending on a strong note for the commercial real estate market. This is the assessment among SIOR members who participated in the 2021 Q4 market conditions survey. Based on their responses, the Commercial Real Estate Index rose to 143.3, up from the prior quarter (143.3) and from one year ago (104.1). An index of 100 indicates “strong” market conditions based on ten indicators pertaining to the national and local economy, leasing, rents, development activity, and commercial real estate prices.

Bolstering the commercial market’s recovery is the demand for industrial real estate, driven by the acceleration of online shopping that depends on a logistics network of warehouses, distribution, and fulfillment centers. The SIOR Industrial Index rose to 161.5, up from the prior quarter (157.8) and from one year ago (122.2). According to US Census Bureau’s retail sales data, the dollar volume of sales of non-store retailers hit $1 trillion in June 2020, and the share of non-store retailers to total retail sales rose to a high of 16.9% in February 2021. According to CoStar® market data, about 700 million square feet of industrial real estate space has been absorbed since the second quarter of 2020 through the fourth quarter of 2021. The industrial vacancy rate has fallen to 4.2% as of the last quarter of 2021 while rents were up 8.7% year-over-year.

The office real estate market continues to recover, though conditions are still not at par with pre—pandemic conditions. The SIOR Office Index rose to 98.4, up from the prior quarter (92.2) and from one year ago (66.2). An index below 100 indicates that market conditions are broadly “weaker” compared to normal market conditions. The number of employees working from home continues to decrease, despite still being elevated compared to the pre-pandemic level. As of November, 11% of the workforce worked from home, or a total of 17.4 million workers. This is down from 35% of the workforce in May 2020, but is higher than the 8 million who worked from home in 2019 before the pandemic hit.

As of Q4 2021, office space occupancy has fallen by 143 million square feet since Q2 2020. The major markets of New York, Los Angeles, San Francisco, Washington DC, and Chicago account for most of the loss in office occupancy, each giving up at least 10 million square feet of office space since the pandemic began in Q2 2020. However, secondary markets like Boise City, Idaho; Durham, N.C.; Palm Beach, Fla.; San Antonio; Austin, Texas; Las Vegas; Provo, Utah; and Fort Myers, Fla. have seen a rise in office occupancy, with each absorbing at least 500,000 square feet of office space since Q2 2020. The office commercial real estate market is still facing a big headwind as the COVID-19 omicron variant that surfaced in November derailed office re-entry plans for many companies, especially among tech companies.

Low mortgage rates and increasing vaccination rates have led to a near normalization of business activity and, therefore, a demand for commercial real estate space. Gross domestic product in the fourth quarter measured at annualized rate is now 3% above the pre-pandemic level and GDP, with GDP growing at an annualized rate of 2.3%. According to the latest December employment report, 19 million nonfarm payroll jobs have been created since May 2020, with just 3.8 million lost jobs to recover. Labor supply has become extremely tight, with more job openings (10.5 million) compared to the number of job seekers (6.5 million) as of December. With improving local and national economic conditions, 72% of respondents reported that local economic conditions had a positive effect on business, up from just 43% one year ago. Sixty-four percent of respondents reported that national economic conditions had a positive effect on business, up from 38% one year ago.

Other findings from the report include*:

- Seventy-five percent of respondents reported they had higher leasing activity, up from just 28% one year ago.

- Eighty-two percent of respondents reported higher rents, up from just 38% one year ago.

- Seventy-two percent of respondents reported they had lower vacancy rates, up from 43% one year ago.

- Sixty-eight percent of respondents that tenant concessions were now more favorable for landlords compared to 41% one year ago.

- Despite the emergence of the omicron variant and the expected uptick in interest rates in 2022, 70% of respondents held a positive outlook about their business in the next 12 months, up from 52% one year ago.

2022 OUTLOOKThe demand for commercial real estate is likely to strengthen in 2022, even as interest rates are likely to increase with three rate hikes anticipated as the Federal Reserve tries to bring inflation back to its long-run goal of 2%, as inflation hit 6.8% year-over-year in November. The office market will likely experience an increase in net absorption with more workers returning to the office, even if on a hybrid schedule. With major companies delaying office re-entry plans, the uptick in occupancy will likely occur in the second half of 2022. However, the ongoing construction of office space will continue to lift the office vacancy rate, which NAR forecasts to hit 13.5% in 2022 (12.2% in 2021). Office rents have generally stopped declining and rent growth will be flat at a broad level. With the hybrid model emerging to be the permanent work style, and given the continued uncertainty about the evolution of the pandemic and new variants, companies are likely to opt for short-term leases and smaller footprints.

Demand for online shopping is likely to remain robust in 2022 and as brick-and-mortars also move towards providing online shopping to complement their in-store services. Both of these forces will drive the demand for industrial space. About 460 million square feet of industrial space is under construction, or about 3% of the current inventory, according to CoStar market data. This added supply will put downward pressure on rent growth. NAR expects industrial rents to rise 7.5% on average from 8.7% as of December. he pandemic and new variants, companies are likely to opt for short-term leases and smaller footprints.

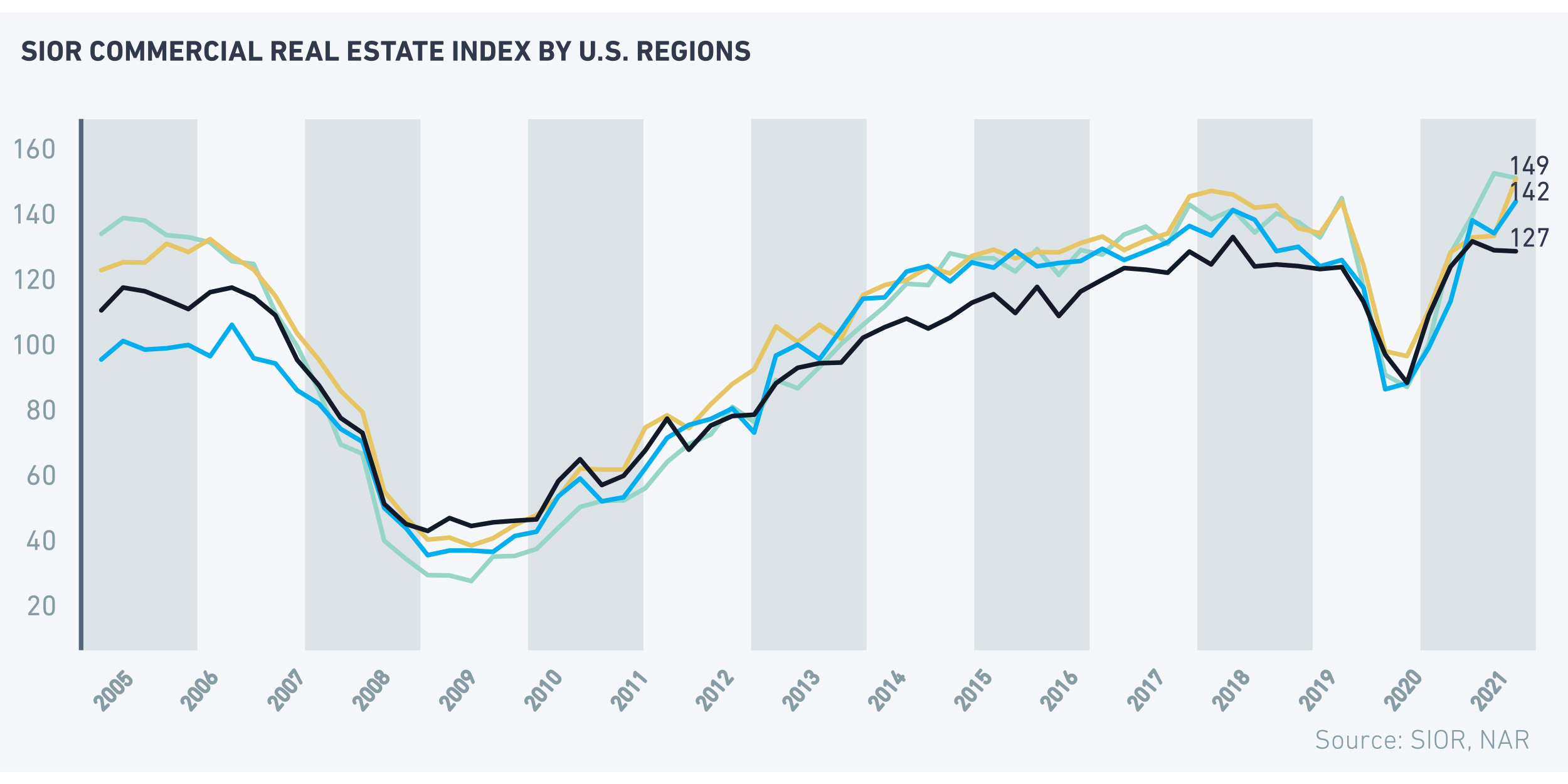

The demand for office space and industrial space is likely to be stronger in the markets with strong housing markets. In its newest report, 2022 Housing Market Hidden Gems, NAR named the top 10 markets with strong underlying housing market fundamentals underpinned by strong job growth, rising wages, and domestic migration, but where housing prices are still undervalued based on the ratio of home prices to income in these markets. These hidden gem markets—all in the Sunbelt states—are Dallas-Fort Worth; Daphne-Fairhope-Farley, Ala.; Fayetteville-Springdale-Rogers, Arkansas-Missouri; Huntsville, Ala.; Knoxville, Tenn.; Palm Bay-Melbourne-Titusville, Fla.; Pensacola-Ferry Pass-Brent, Fla.; San Antonio-New Braunfels, Texas; Spartanburg, S.C.; and Tucson, Ariz.

* Numbers reflect U.S. member reporting only and vary slightly from SIOR’s global Sentiment Report findings.