Commercial Real Estate Index

Industrial and office commercial activity and market conditions weakened somewhat in the second quarter of 2019 compared to conditions in the first quarter, according to a joint survey of the Society of Industrial and Office REALTORS® (SIOR) and the National Association of REALTORS®. A higher fraction of respondents reported less development activity in the second quarter of 2019, rising site acquisition costs, and less favorable investment pricing conditions. The slowdown in the office and industrial markets comes at a time of a slowdown in overall private investment activity, heightened trade tensions, and increased expectations of an economic slowdown in the next year or two.

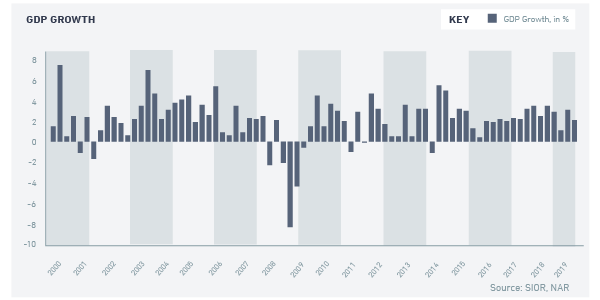

Q2 SLOWER ECONOMIC GROWTH IN 2019

Now on its 11th year of expansion, the U.S. economy is still expanding although at a slower pace of 2.1%, down from 3.1% in the first quarter. The growth was driven by personal consumption (4.3%) and government consumption and investment spending (5%). On the other hand, fixed investment spending declined (-0.8%) for both commercial (-1.5%) and residential structures (-1.5%). Exports of goods and services fell (-5.2%) while imports rose modestly (0.1%).

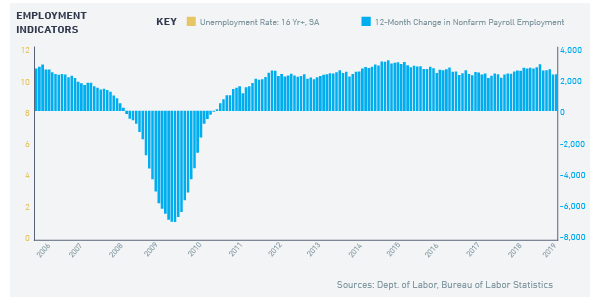

The economy is still in job-creation mode, with 2.3 million more payroll workers in July 2019 compared to one year ago. As of July 2019, the unemployment rate was at 3.7%, a rate last seen 50 years ago (Sept-Oct 1969). As of June 2019, there were more job openings (6.6 million) than job seekers (6.0 million). In the construction industry, the gap between job openings (347,000) and job seekers (390,000) has continued to narrow, which means it will be harder to find workers for commercial development. Given the tight labor market and modest inflation (1.6%), wages rose in real terms in June 2019 (2.8%). Rising real wages boosts consumer purchasing power, but it also creates upward pressure on development costs.

In the past 12 months that ended June 2019, all industries added more to their payrolls, except for information services (-13,000) and retail trade (-73,200). Professional and business services industry created nearly half a million jobs while transportation and warehousing generated nearly 140,000 jobs.

COMMERCIAL ACTIVITY AND PRICES WEAKEN IN THE SECOND QUARTER

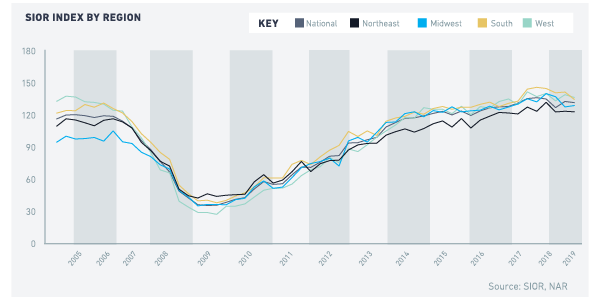

The SIOR CRE Index1 is still trending above 100, but the index slightly decreased to 130.9 in the second quarter of 2019 (132 in 2019 Q1; 135.5 in 2018 Q2). Based on the 10 components that make up the index, the decrease can be attributed to slower development activity, and this may be associated with rising site acquisition costs and the tight labor market. More respondents also reported that investment.

Pricing conditions made it less profitable to engage in new construction. While economic conditions were broadly viewed by respondents as positive, a higher fraction reported that negative local economic conditions. Leasing conditions weakened somewhat though more respondents reported tighter vacancy conditions and an increase in asking rents (Box 1).

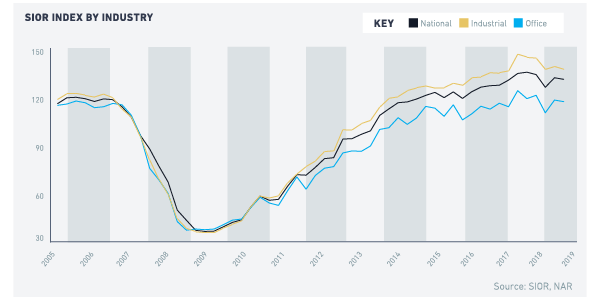

INDUSTRIAL MARKET STILL OUTPERFORMING THE OFFICE MARKETBoth industrial and office indices decreased compared to the past quarter and year-ago levels: the SIOR CRE Index-Industrial decreased to 137.1 (138.9 in 2019 Q1; 144.7 in 2018 Q2) and the SIOR CRE Index-Office declined to 117.2 (118.3 in 2019 Q1; 118.9 in 2018 Q2). While the indices declined somewhat, both indices are still above 100, indicating a growing rather than a weakening market. The SIOR CRE Index-Industrial continues to move above the industrial SIOR CRE Index-Office on account of the strong demand for industrial warehouses arising from the demand for quick and efficient delivery of offline and online customer orders.

Regionally, industrial and office activity is strongest in the West (135.7) and the South (133.8) followed by the Midwest (128.2) and the Northeast (122.4). Compared to the past quarter, all regional indices decreased except in the Midwest.

| Industrial and Office Market Conditions in 2020 Third Quarter - A smaller fraction of respondents reported that leasing activity exceeded historical levels in 2019 Q2 declined to 58% (65% in the prior quarter).

- However, a higher fraction of respondents reported an increase in asking rents from one year ago, at 78% (35% in the prior quarter).

- A higher fraction of respondents reported that vacancy conditions tightened in 2019 Q2 compared to one year ago, at 57% (50% in the prior quarter).

- A higher fraction of respondents reported tight subleasing availability compared to normal volume of sublet space, at 70% (60% in the prior quarter).

- About the same fraction of respondents reported tenant concessions remained skewed in favor of landlords compared to normal negotiating conditions, at 56% (57% in the prior quarter).

- A smaller fraction of respondents reported that development activity is above historical level, at 57% (63% in the past quarter).

- A higher fraction of respondents reported rising site acquisition costs, at 71% (67% in the past quarter).

- A smaller fraction of respondents reported that investment pricing conditions are above replacement cost (profitable to build), at 42% (49% in the past quarter).

- While majority of respondents view local economic conditions as positive, a slightly higher fraction of respondents reported weaker local economic conditions, at 6% (4% in the past quarter)

- About the same fraction of respondents viewed national economic conditions as having a positive influence on business, at 63 percent (same as in the past quarter).

|

1-The index is based on 10 variables pertinent to the performance of U.S. industrial and office markets: leasing activity, asking rents, vacancy, subleasing conditions, tenant concession, development conditions, site acquisitions conditions, investment pricing conditions, local economic conditions, and U.S. economic conditions. An index value of 100 shows a balanced market, while an index above 100 indicates growing conditions, having surpassed its historical average.