Commercial Real Estate Index

The 2020 second quarter survey of SIOR members provides another indicator of the big blow dealt by the coronavirus pandemic on the commercial real estate market.

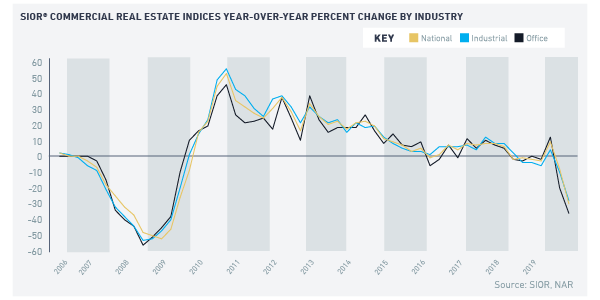

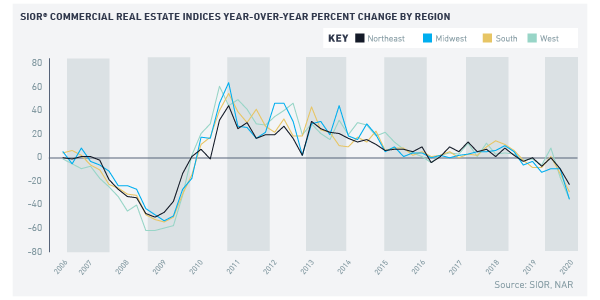

The SIOR® Commercial Real Estate Index—an index that is based on 10 indicators of sales/acquisitions, leasing, and development compiled from a survey of SIOR members—dropped by 31% on a year-over-year basis. The pandemic has hit the office market harder than the industrial sector, as evidenced by the SIOR Office Index dropping 37% year-over-year, while the SIOR Industrial Index dropped 20% year-over-year. The SIOR Index fell across all regions: Northeast (-22%), Midwest (-34%), South (-28%), and West (-34%).

Respondents reported a deterioration in leasing activity, a decrease in office and industrial rents, higher vacancy rates, a decline in development activity, and deterioration in the overall and local economic conditions. Seventy-eight percent of respondents reported that leasing activity was lower than the historical volume, and 38% of respondents reported tighter vacancy rates compared to one year ago. Forty-two percent of respondents reported a decline in acquisition prices.

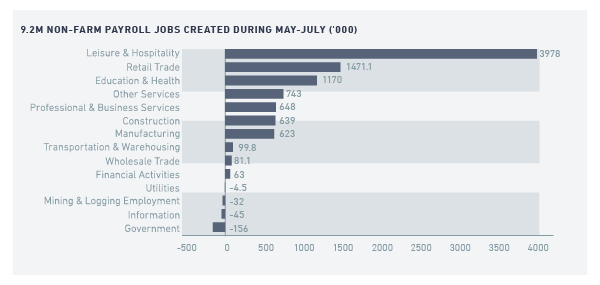

TOUGHER RECOVERY FOR OFFICE SECTORA variety of indicators shows that the second quarter decline is the trough of recession and that economic activity is starting to turn up. During May through July, 9.2 million non-farm payroll jobs have been created, although nearly 12 million jobs have yet to be recovered from the level in February. All broad industry sectors had net job creation, except for mining and logging, information, and government.

The office-using industries—professional and business services and financial activities (composed of finance and insurance; real estate, rental, and leasing)—created 711,000 jobs during May through July. Industries that are the primary drivers of the demand for industrial space—retail trade, wholesale trade, manufacturing, and transportation and warehousing—also saw job 951,000 net new jobs gains during the same period.

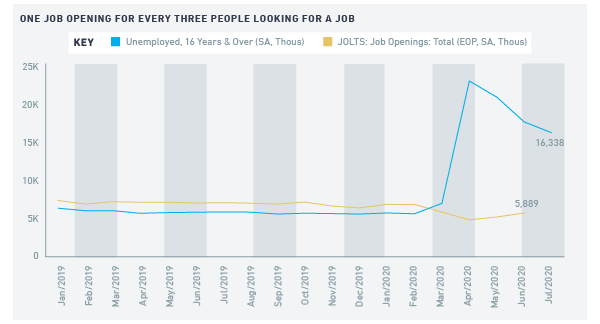

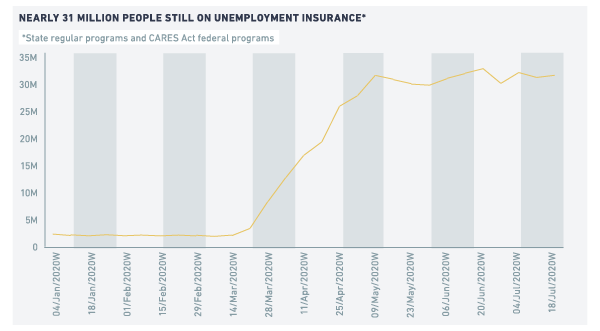

However, there’s still a lot of economic slack, measured by several unemployment indicators, meaning vacancy rates for office space will remain elevated until economic activity returns to a level such that employment recovers to pre-pandemic level. As of June, there were 5.9 million job openings compared to 16.3 million people looking for work, or 1 job opening for every 3 unemployed workers. As of the week of July 18, there are nearly 31 million claiming unemployment insurance, 15x the pre-pandemic level1.

| Industrial and Office Market Conditions in 2020 Second Quarter - 78% of respondents reported that leasing activity was lower than the historical volume (40% in the prior quarter).

- 25% of respondents reported a decrease in asking rents from one year ago in their markets (8% in the prior quarter).

- 37% of respondents reported tighter vacancy conditions compared to one year ago (8% in the prior quarter).

- 275% of respondents reported a glut in subleasing availability compared to normal volume of sublet space (8% in the prior quarter).

• 48% of respondents reported deep discounts for tenants (22% in the prior quarter). - 45% of respondents reported development activity is below historical level (33% in the prior quarter).

- 21% of respondents reported site acquisition costs are falling (12% in the prior quarter).

- 42% of respondents reported investment pricing conditions are below replacement cost and that it was profitable to build (37% in the prior quarter).

- 42% of respondents reported weaker local economic conditions (37% in the prior quarter).

- 43% of respondents viewed national economic conditions as having a negative effect on (20% in the prior quarter).

- 82% of respondents expect the economy to have a negative effect on their market in the upcoming quarter (43% in the prior quarter)

|

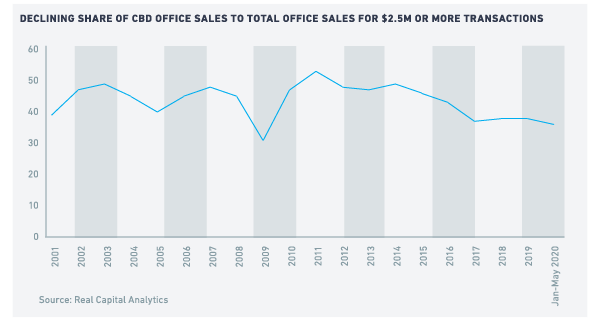

INCREASING TREND TOWARDS SUBURBAN OFFICE SPACEOne of the key questions about the effect of the coronavirus on the office outlook is the potential shift towards the suburban market. Suburban office space acquisitions have been on the rise since 2017, but this trend may pick up as a result of social distancing and increased opportunity to work from home.

The increasing trend towards suburban office development may continue for two reasons: the price differential, and the potential movement of people to the suburbs, which offer more affordable housing and more space. On average, a square foot of office central business district (CBD) cost $500 as of May, compared to $238 for a square foot of suburban office space. As the price of CBD office space started to outpace the price of suburban office space starting in 2011, the share of CBD sales also started declining.

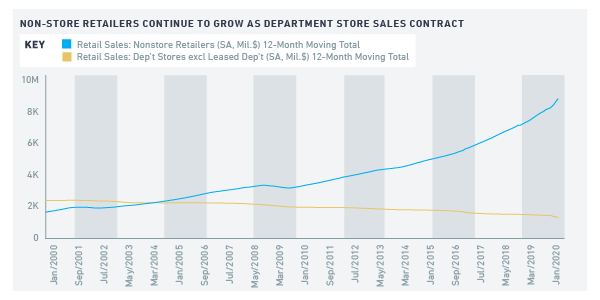

E-COMMERCE TO CONTINUE TO SUPPORT DEMAND FOR INDUSTRIAL SPACEIndustrial real estate has arguably been the strongest sector during this downturn as e-commerce sales continue to make inroads into brick and mortar sales. As of June, the annual dollar volume of non-retailers is now hovering at about $862 billion a year, up from an annual level of $799 billion in January. According to JLL, the vacancy rate in the second quarter remained a low 6%. Vacancy rates rose slightly in the wake of the shutdown but leasing velocity picked up significantly in May and June.

1-Claimants under the regular state programs (16.8 million) as well as self-employed/gig workers/part-time who are able to claim under the CARES Act Pandemic Unemployment Assistance (12.9 million) and those on additional 13 weeks of benefit paid under the CARES Act Pandemic Emergency Unemployment Compensation (1.1 million).