Commercial Real Estate Index

NAR ECONOMIC OVERVIEW

The economy maintained an expansionary trajectory during the fourth quarter of 2018, with employment trends indicating solid growth. Payroll employment advanced, with a net increase of 695,000 new jobs, based on data from the Bureau of Labor Statistics. The quarterly figure rounded up employment gains to 2.7 million net new jobs created during 2018.

Private service-providing industries accounted for the majority of new positions, with 549,000 net new jobs added to payrolls during the fourth quarter. Within the service industries, the quarter’s strongest gains were in the leisure and hospitality sector, which added 173,000 new positions. The fourth quarter comprises the traditional holiday season—including Thanksgiving—when many consumers travel, and demand for lodging picks up.

The education and health care sectors also boosted their payrolls to the tune of 133,000 new jobs. The professional and business services sector rounded out the top three with the strongest gains, with 118,000 new payroll positions.

The other service sectors also notched solid gains. Transportation and warehousing benefitted from the trade activity, adding 43,000 new jobs. Wholesale trade contributed 28,900 new positions to payrolls, while financial services added 21,000 new positions. The manufacturing sector continued boosting its payrolls, with the addition of 76,000 new positions during the fourth quarter, while the construction industry added 58,000 new positions.

The upward hiring trends in the office and industrial-using sectors had a positive impact on these two property types. Vacancy rates for office properties declined 10 basis points in the fourth quarter, to 12.6 percent, as the average asking rent increased 2.7 percent during the year, based on data from CBRE. Conversely, the availability rate for industrial properties slid 10 basis points to 7.0 percent, the lowest level since the last quarter of 2000, according to CBRE. Industrial net asking rent rose to $7.37 per square foot in the fourth quarter, a 2.2 percent increase.

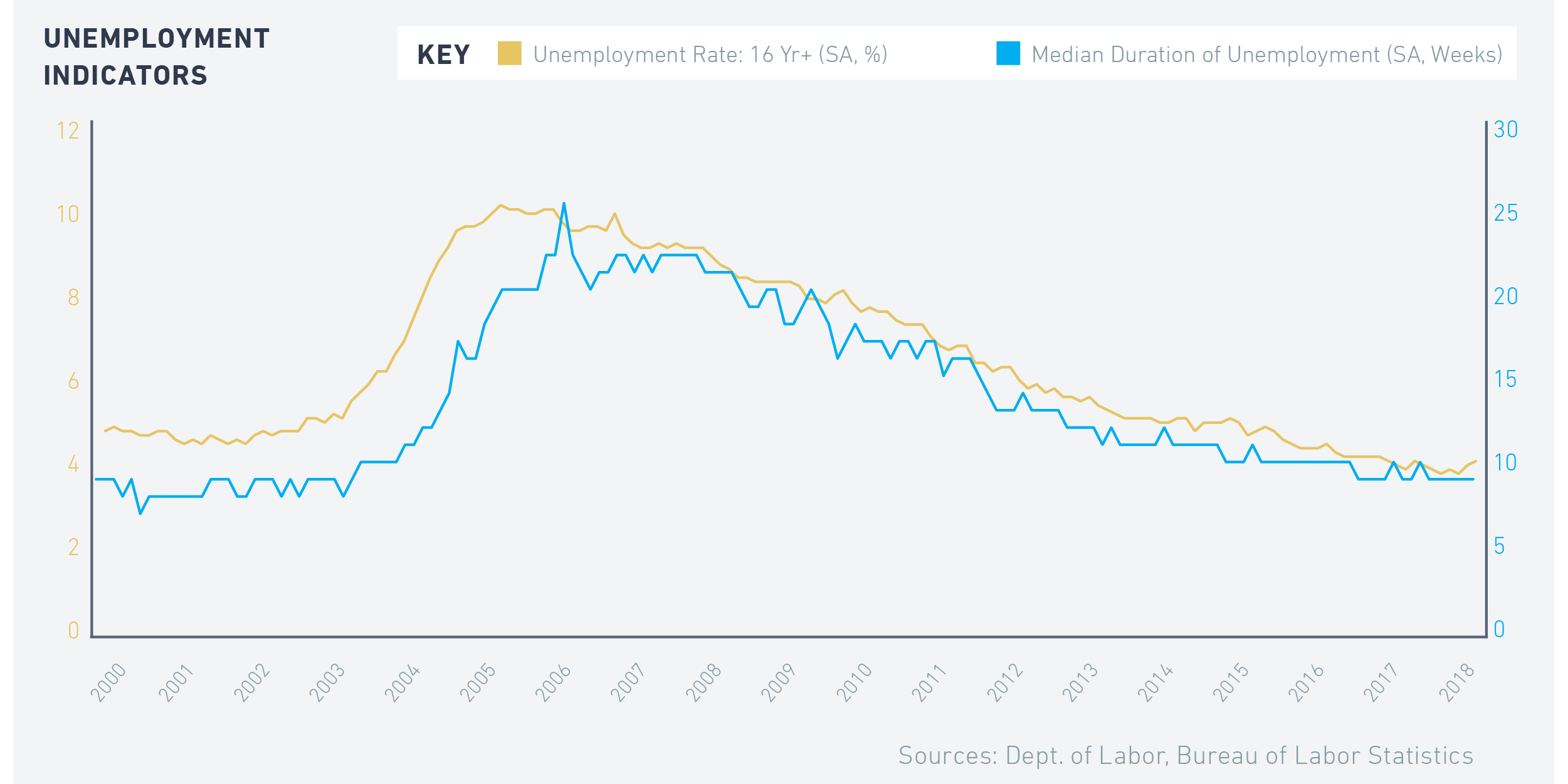

The quarterly unemployment rate moved sideways during the fourth quarter, averaging 3.8 percent, on par with the third quarter’s rate. However, more workers entered the labor force during the quarter, as the labor force participation rate ticked up to 63.0 percent from the third quarter’s 62.8 percent. In turn, the unemployment rate rose slightly in January of this year, to 4.0 percent. The number of workers employed on a part-time basis for economic reasons moved from 4.5 million in the third quarter to 4.7 million in the fourth quarter.

The fourth quarter was marked by increased volatility in financial markets, which left an imprint on business and consumer confidence. The Institute for Supply Management Composite Index picked up slightly in the fourth quarter, moving to a value of 59.2 (an index value above 50 is indicative of increasing manufacturing and nonmanufacturing activity), up 2.4 percent from the prior year. However, the index’s value dropped to 56.7 in January of this year.

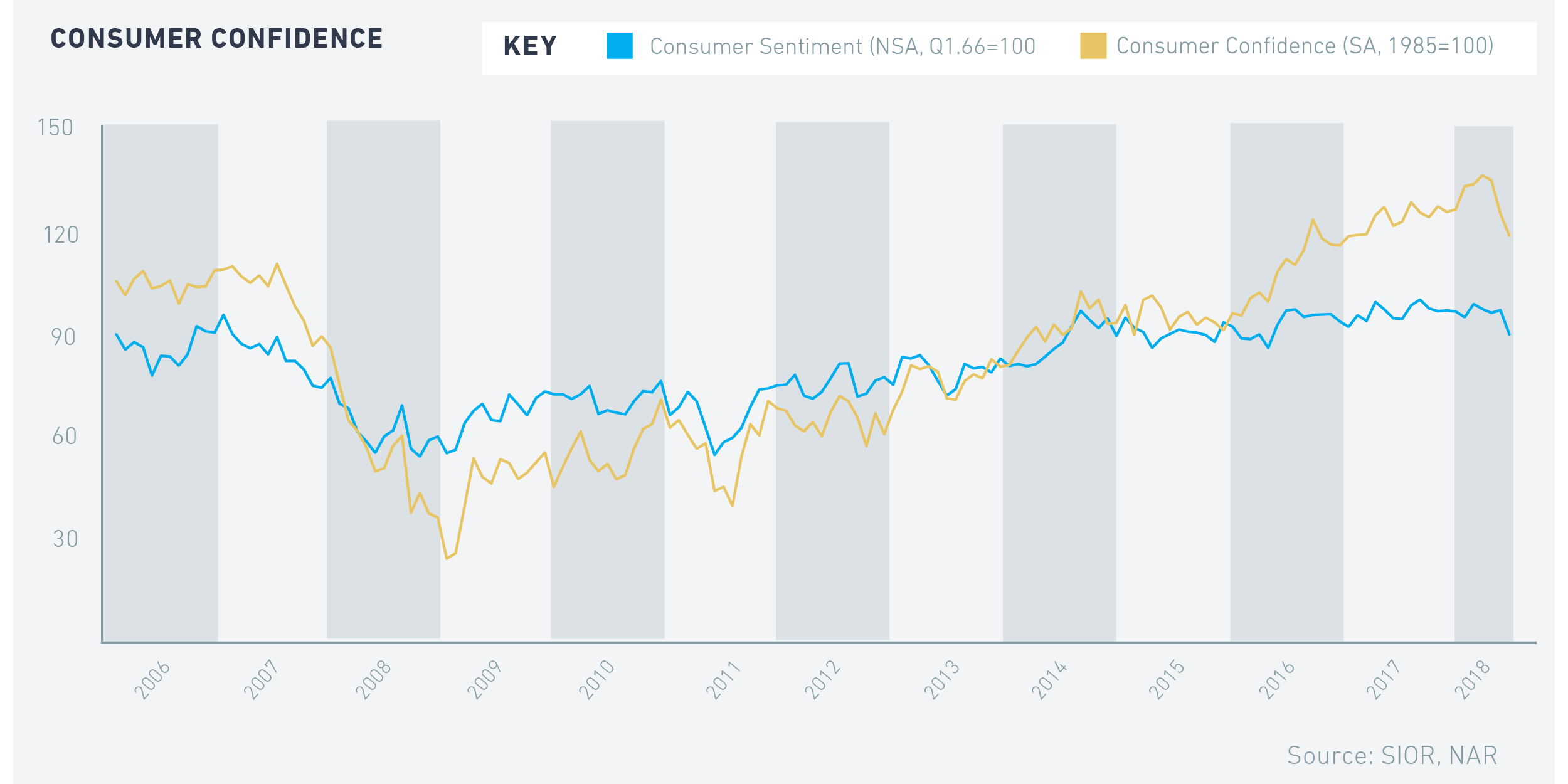

Consumer confidence advanced in the fourth quarter, with the Conference Board’s Consumer Confidence Index increasing 6.0 percent year-over-year, to 133.6, the highest quarterly value since the third quarter of 2000. However, the financial markets’ performance during the fourth quarter left a mark on consumers, as the Consumer Confidence Index declined sharply in January of 2019, to 120.2. Separately, the Consumer Sentiment Index compiled by the University of Michigan slid in the fourth quarter of the year at 98.1, compared with the 98.4 value from the same quarter of 2017. The index ticked lower in January of this year, to 91.2.

Based on data from the National Association of REALTORS®, economic activity in the fourth quarter was expected to post a 2.0 percent advance, a slowdown in growth from the prior two quarters. Gross domestic product for 2018 was expected to close the year at a positive 3.1 percent annual rate of growth, a solid performance despite fourth quarter moderation.

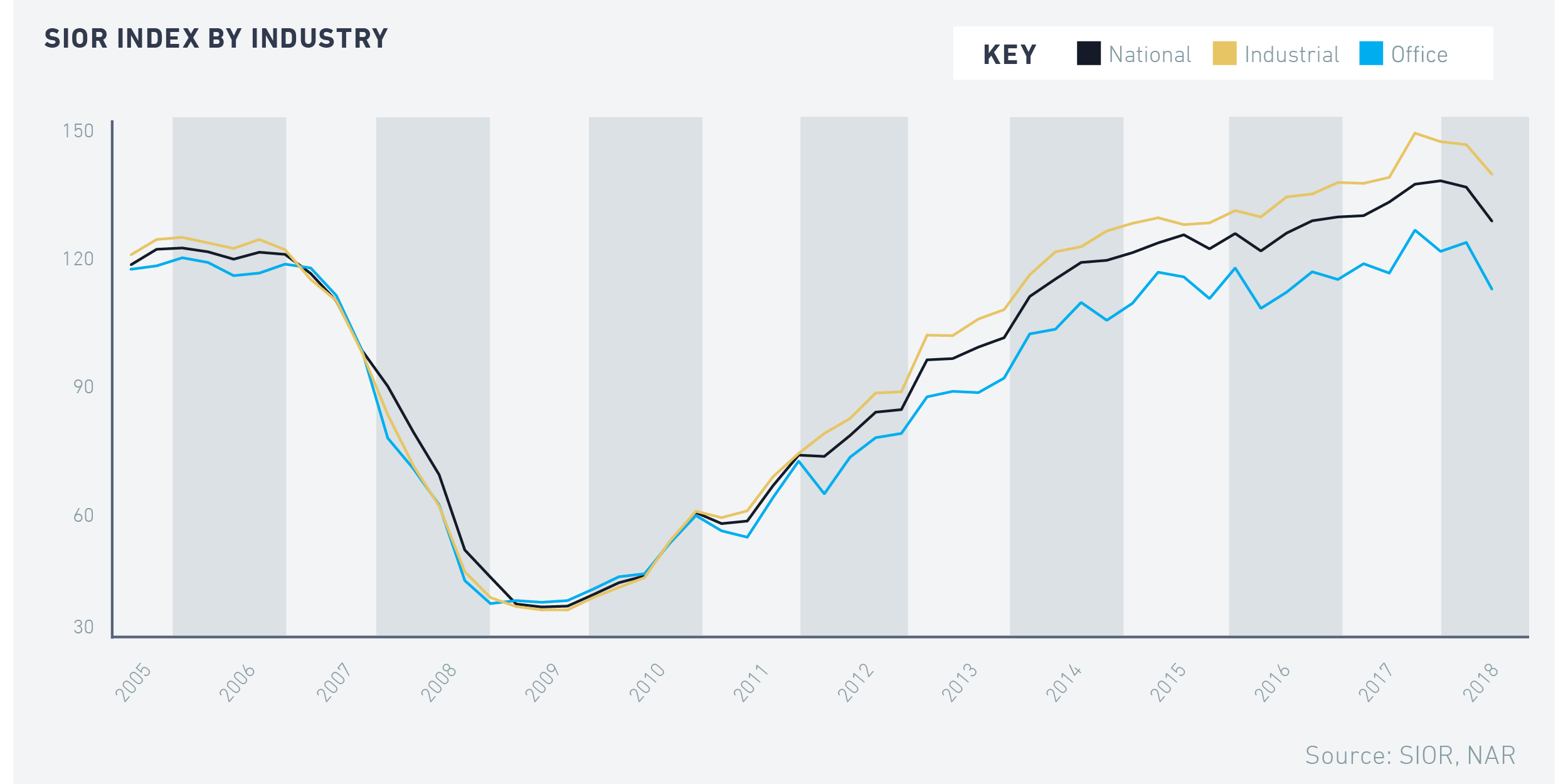

SIOR INDEX RESULTSBased on the SIOR Commercial Real Estate Index, commercial markets reflected broader economic and financial markets’ shifts. The SIOR CRE Index, representing fourth quarter 2018 data, decreased 8.0 points from the third quarter of 2018. Compared with the prior year, the index declined 3.2 percent. The national index, based on 10 variables pertinent to the performance of U.S. industrial and office markets, closed at 126.3. An index value of 100 shows a balanced market, meaning that the current value of the national index is pointing to growing conditions, having surpassed its historical average. Even with the decline, the figure represents the eighteenth consecutive quarter with a value above the 100-point threshold since the Great Recession.

Conditions in office and industrial markets moderated during the quarter. The office index slid from a value of 120.6 in the third quarter to 110.4 in the fourth quarter. On a yearly basis, the office index recorded a 3.0 percent decline. The industrial index decreased to 137.0 in the fourth quarter of 2018, a 4.8 percent loss from the prior quarter. However, the industrial index was 0.5 percent higher year-over-year.

SIOR members reported shifts in fundamentals, indicating softening market activity.

- Leasing activity exceeded historical levels for 51 percent of SIORs who responded to a market survey.

- Rents remained positive but slowed—73 percent ascertained that rents were above historical trends (compared with 82 percent the prior quarter). Meanwhile, 22 percent indicated that rents were in line with long-term averages, and five percent of SIOR members considered that asking rents were below those of one year ago.

- Vacancies continued declining, with 53 percent of respondents reporting lower availability rates (compared with 61 percent in the third quarter).

- Subleasing availability also declined, with seven percent of SIOR respondents feeling that there was ample sublease space in their markets; 62 percent considered subleasing to have a small influence on the market.

- New construction of office and industrial spaces remained positive, with 52 percent of SIOR members reporting new construction during the quarter, and 15 percent indicating new building development close to historical averages.

- Development conditions continued favoring sellers during the period, with 68 percent of SIORs rating it a seller’s market. Investment prices were above costs for 37 percent of respondents.

Local economies provided positive contributions to local real estate markets, however the share of respondents indicating strong conditions weakened. During the fourth quarter, 61 percent of SIOR respondents indicated that their local economies were strong and improving, compared with 75 percent in the third quarter. The national economy offered a more nuanced impact on local markets, with 59 percent of SIOR responses indicating a positive impact upon their markets, compared with 57 percent in the third quarter. Nine percent of SIOR respondents experienced a negative impact upon their markets from national economic conditions (the remainder was neutral).

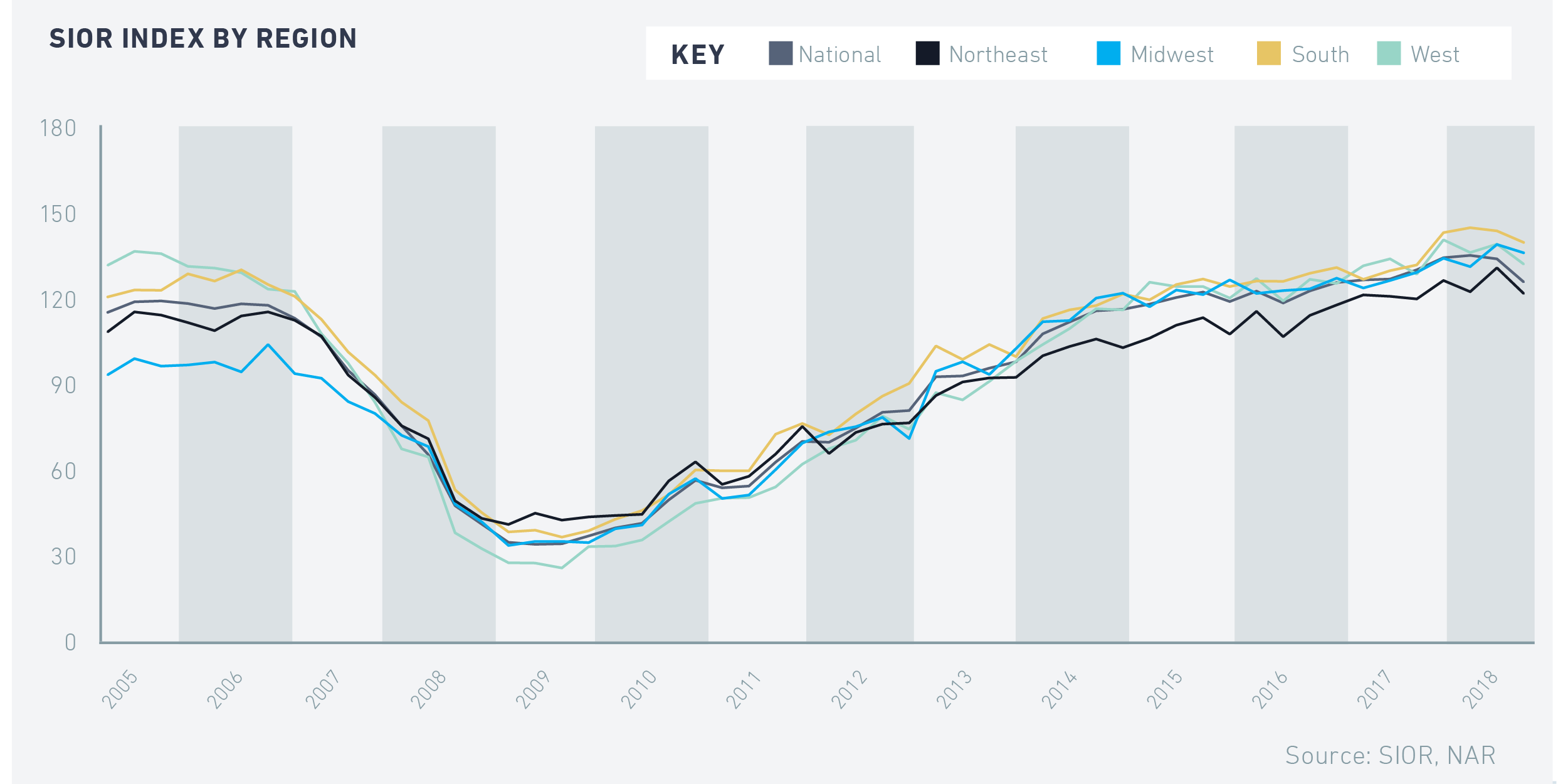

Regionally, survey respondents expressed stable conditions during the period, still above 2017 levels. The South posted the highest index value, at 140.0, with a 5.9 percent yearly gain. The Midwest recorded the second highest regional index value, at 136.4, a 5.2 percent advance. The West—with an index value of 132.5—rose 2.7 percent from a year ago. The Northeast posted a 1.6 percent gain from the prior year, to a value of 122.3 during the quarter.

The outlook for the first quarter of 2019 indicated continued moderation. SIOR members expected conditions to improve—43 percent of respondents indicated growth in the “1-15 percent” range. However, the figure was lower than the 56 percent with the same response in the third quarter. Meanwhile, 39 percent of respondents felt the market will be maintaining current levels. A growing share of SIOR members—19 percent in the fourth quarter vs. four percent in the second and nine percent in the third—expected conditions to decline.

1-The index is based on 10 variables pertinent to the performance of U.S. industrial and office markets: leasing activity, asking rents, vacancy, subleasing conditions, tenant concession, development conditions, site acquisitions conditions, investment pricing conditions, local economic conditions, and U.S. economic conditions. An index value of 100 shows a balanced market, while an index above 100 indicates growing conditions, having surpassed its historical average.