Commercial Real Estate Index

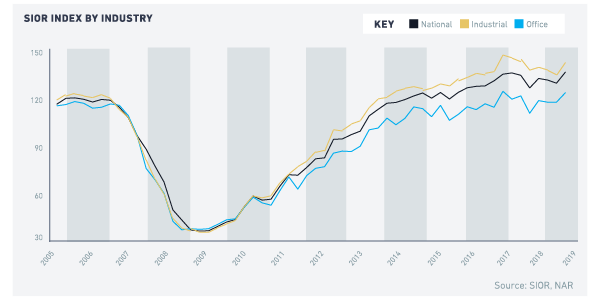

SIOR members who participated in SIOR’s latest survey seemed to have weathered fairly well the headwinds facing the economy, including higher trade tariffs between the U.S. and China, and the ensuing decline in business spending, trade, and manufacturing activity. SIOR members who responded1 to the quarterly survey on business and economic conditions indicated an expansion in commercial activity in 2019 Q4 from one year ago. The SIOR Commercial Real Estate Index—an index that is based on 10 indicators of sales/acquisitions, leasing, and development—increased to 136.1 after sliding downwards since the second quarter of 2018.2

The respondents reported improving conditions in both the industrial and office markets, with higher indices in both markets compared to the prior quarter. The industrial market continues to outperform the office market, indicated by the higher value of the SIOR CRE Index-Industrial of 142 compared to the SIOR CRE Index-Office of 123.

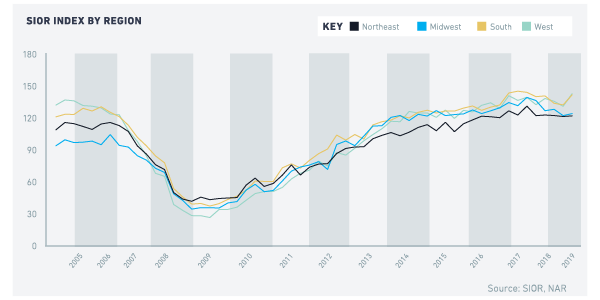

Respondents reported an increase in industrial and office activity in all four U.S. regions, led by the West (143) and South (142) regions, followed by the Midwest (124) and the Northeast (122.5)

MARKET INDICATORS OF DEMAND AND SUPPLY

Majority of the respondents reported tighter vacancy rates (60%) and higher asking rents (87%) and that they did not offer tenant concessions (60%). A majority also reported more development activity compared to historical level (63%) and that acquisition costs are rising (74%). Less than half reported that it is profitable to build (46%). (Box 1)

Respondents are optimistic about economic conditions in the upcoming quarter: 62% of respondents expect the economy to have a positive influence on their business the coming quarter. This positive expectation may be associated with the signing of the Phase One Trade Deal between the United States and China. The deal calls for measures $200 billion of additional imports from China compared to the 2017 level, increased trade in agricultural products, and protection of intellectual property rights. (Note: the 2019 Q4 survey was conducted in early January 2020 when the coronavirus outbreak had not made it as headline news).

| Box 1: Industrial and Office Market Conditions in 2019 Fourth Quarter - 60% of respondents reported that leasing activity was higher than the historical volume (59% in the prior quarter).

- 87% of respondents reported an increase in asking rents from one year ago (78% in the prior quarter).

- 60% of respondents reported tighter vacancy conditions compared to one year ago (58% in the prior quarter).

- 70% of respondents reported tight subleasing availability compared to normal volume of sublet space (66% in the prior quarter).

- 60% of respondents reported no tenant concessions (51% in the prior quarter).

- 63% of respondents reported development activity is above historical level (50% in the prior quarter).

- 74% of respondents reported site acquisition costs are rising (58% in the prior quarter).

- 46% of respondents reported investment pricing conditions are above replacement cost and that it was profitable to build (46% in the prior quarter).

- 46% of respondents reported stronger local economic conditions (67% in the prior quarter).

- 21% of respondents viewed national economic conditions as having a positive effect on (60% in the prior quarter).

- 62% of respondents expect the economy to have a positive effect on their market in the upcoming quarter (54% in the prior quarter).

|

ECONOMIC CONDITIONS

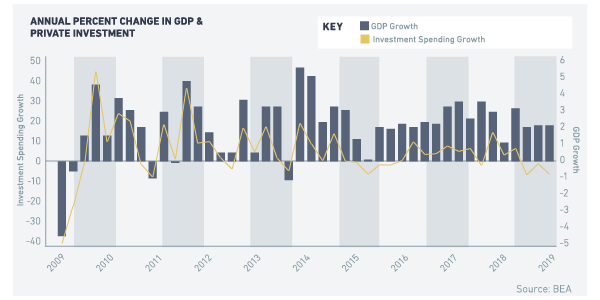

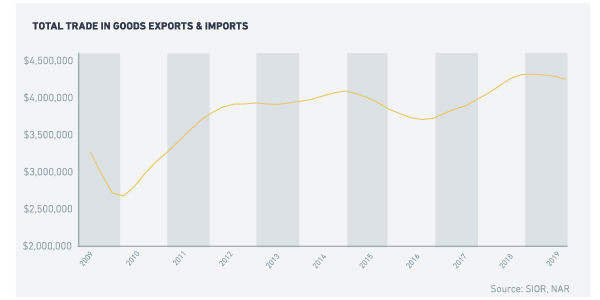

Respondents reported an improvement in business conditions even as economic growth slowed in 2019 Q4 due to a contraction in business investment spending and trade volume (exports and imports). GDP growth slowed to 2.1% in the fourth quarter of 2019 after posting a 3.1% annual growth at the beginning of the year, mainly weighed down by three quarters of decline in investment spending.

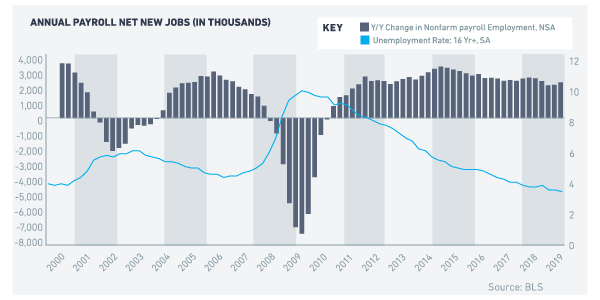

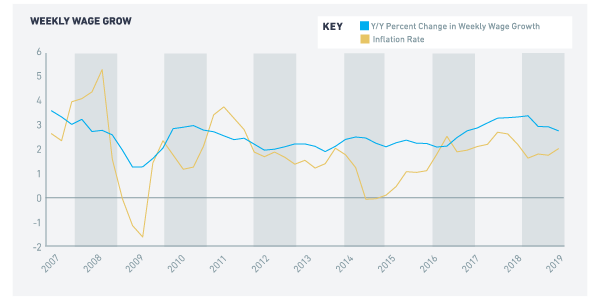

However, even as economic growth slowed, employment conditions were still strong, which may account for the uptick in commercial business among the respondents. The economy created nearly 2 million private sector jobs in 2019, pushing down the unemployment rate to 3.5% in 2019 Q4—the lowest rate in nearly 50-years. As the unemployment rate has fallen, wages have been rising at a pace faster than inflation, increasing the spending power of consumers. Average weekly wages rose nearly 3% in 2019 Q4 from one year ago, while the inflation rate remained subdued at around 2%.

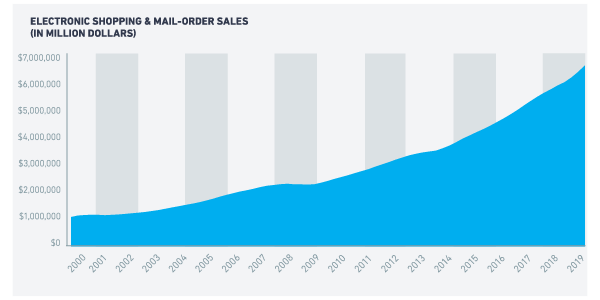

Meanwhile, the demand for industrial office space continues to be driven by strong e-commerce sales that relies on an efficient logistics network of warehousing, distribution, and last-mile delivery services. Valued at $666 billion, electronic and mail-order sales now account for nearly 11% of retail sales, up from just 3% in 2000. Consumer spending in general has held up well given the low level of unemployment and rising wages. Consumer spending has been the economy’s main engine of growth, making up for the contraction in business investment spending and weaker trade volume.

1-118 respondents responded to the 2019 Q4 survey

2-An index above 100 which means that more respondents reported favorable than unfavorable conditions from one year ago or against their perceived historical normal level of activity.