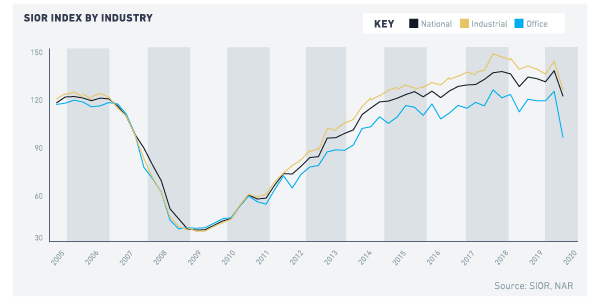

The SIOR Commercial Real Estate Index—an index that is based on 10 indicators of sales/acquisitions, leasing, and development compiled from a survey of SIOR members—fell to 120 in 2020 Q1, a 16% drop from the prior quarter’s reading, and a 12% drop from the level one year ago. The index’s decline is yet another indicator of the unintended economic effect of the social distancing measures put in place to combat the spread of the Coronavirus.

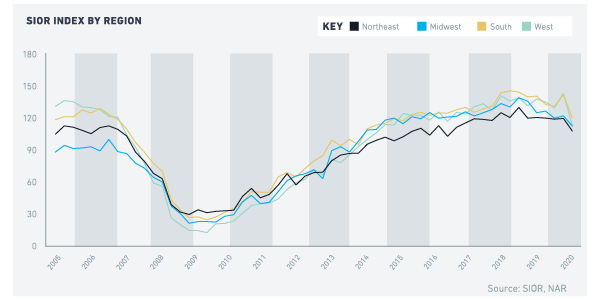

The SIOR Office Index fell more steeply than the SIOR Industrial Index, as small and big businesses alike grapple with the short- and long-term effect of the economic shutdown on their financial viability and survival. The SIOR Office Index dropped 29% while the SIOR Industrial Index dropped 18%, rates of decline not seen even during the Great Recession. The index fell across all regions as well, with the largest drop in the West region: Northeast (-9%), Midwest (-7%), South (-14%), and West (-19%).

Respondents reported weaker leasing activity and more landlords giving tenant concession. However, majority of respondents—59%—continued to report that vacancy rates in their markets were still tight compared to the normal long-term average. Only 8% of respondents reported an increase in asking rents, although this is higher than the 4% share of respondents who reported higher rents one quarter ago (Box 1). Seventy-four percent of respondents expect the economy to have a negative effect on their market in the upcoming quarter, up from 9% in the prior quarter

| Industrial and Office Market Conditions in 2020 First Quarter - 40% of respondents reported that leasing activity was lower than the historical volume (13% in the prior quarter).

- 8% of respondents reported a decrease in asking rents from one year ago in their markets (3% in the prior quarter); however, majority reported that asking rents are higher (59% in 2020 Q1; 87% one quarter ago).

- 59% of respondents reported tighter vacancy conditions compared to one year ago (60% in the prior quarter).

- 55% of respondents reported tight subleasing availability compared to normal volume of sublet space (70% in the prior quarter).

- 22% of respondents reported tenant concessions (14% in the prior quarter).

- 33% of respondents reported development activity is below historical level (25% in the prior quarter).

- 55% of respondents reported site acquisition costs are rising (74% in the prior quarter).

- 37% of respondents reported investment pricing conditions are below replacement cost and that it was profitable to build (33% in the prior quarter).

- 37% of respondents reported weaker local economic conditions (33% in the prior quarter)

- 43% of respondents viewed national economic conditions as having a negative effect on (20% in the prior quarter).

- 74% of respondents expect the economy to have a negative effect on their market in the upcoming quarter (9% in the prior quarter)

|

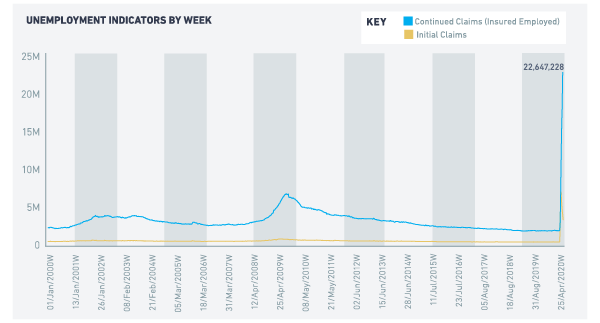

ECONOMIC CONDITIONS AND OUTLOOKThe social distancing measures have already resulted in an unprecedented loss of jobs. During the weeks of March 21 through May 2, 33.5 million people filed for unemployment insurance on a seasonally adjusted basis. As of April 25, there were 22.6 million from 1.7 million as of March 7, an increase of 20.8 million people claiming unemployment insurance in the past two months.

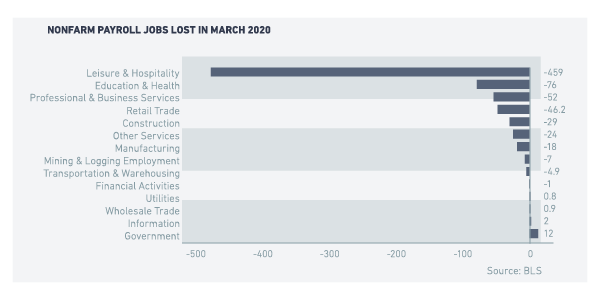

In March 2020, 701,000 non-farm employment jobs were lost in all industries (2-digit level) except in the utilities, wholesale trade, information, and the government sectors. Sixty-five percent of the job losses were in leisure and hospitality (-459,000). Professional and business services lost 52,000 jobs.

The federal government and the Federal Reserve Board are pulling out all the stops to contain the economic fallout and to ensure that the economy remains resilient and poised for a strong recovery when social distancing measures ease.

On March 6, the President signed an $8.3 billion coronavirus bill that provides funding towards the treatment and prevention of the spread of COVID-19. On March 13, President Trump declared the COVID-19 pandemic a national emergency, freeing up $50 billion in federal resources to contain the spread of the virus. On March 27, the President signed the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide financial assistance to individuals, businesses, and states. The Act included a $349 billion Payment Protection Plan (PPP) that provides funding for forgivable loans to small businesses to incentivize them to retain their employees. With a deluge of applications, the PPP was depleted within one month. On April 21, the Senate passed a $483 billion Coronavirus aid package to replenish the PPP program and provide funding for hospitals and to ramp up Coronavirus testing. The House and President Trump signed the bill on April 23.

Regarding monetary policy, the Federal Open Market Committee reduced the Federal Funds rate to a range of 0%-0.25% on March 15. The Federal Reserve Board also lowered the discount window primary credit rate by 150 basis points to 0.25%, effective March 16, 2020, to encourage depository institutions to access the Federal Reserve Bank’s discount window, its lending facility for depository institutions, to help meet the demand for credit from households and businesses.

INDUSTRIAL AND OFFICE MARKET OUTLOOKAs NAR wrote in the April 2020 Commercial Market Trends and Outlook Report, the demand for industrial properties is tilted more upside than downside. The shift towards online shopping will only continue to increase the demand for industrial warehouses. Warehouses will also likely be in demand to serve as armories for storing equipment and other personal protection equipment in preparation for the resurgence of the COVID-19 or some other deadly virus. Vacant retail malls can be used as armories as well.

The outlook for the office sector is tilted on the downside. Businesses will likely put on hold new hiring of employees given the uncertainty of a resurgence of the Coronavirus pandemic and until after a vaccine is found. Leases will likely become more short-term, and businesses may opt for smaller office spaces so they are not faced with high rent costs if another health crisis emerges. Workers who may have wanted to work in shared spaces may remain wary for some time to keep safe and to work from home rather than in co-working spaces.

The economy is likely to contract in the first and second quarters, with a steep contraction in the second quarter. Whether the economy will have a sharp V-shaped recovery or a slow recovery will depend on the response of the economy to the stimulus package and the path of virus containment. The prognosis of the director of the Center for Disease Control that the virus may resurface in the fall adds another cloud of uncertainty that can pull back investment spending. Given current economic indicators, we expect GDP to contract around 4.5% in 2020.