This writeup reflects data from U.S.-only respondents. For a report on global conditions, see the SIOR Sentiment Report.

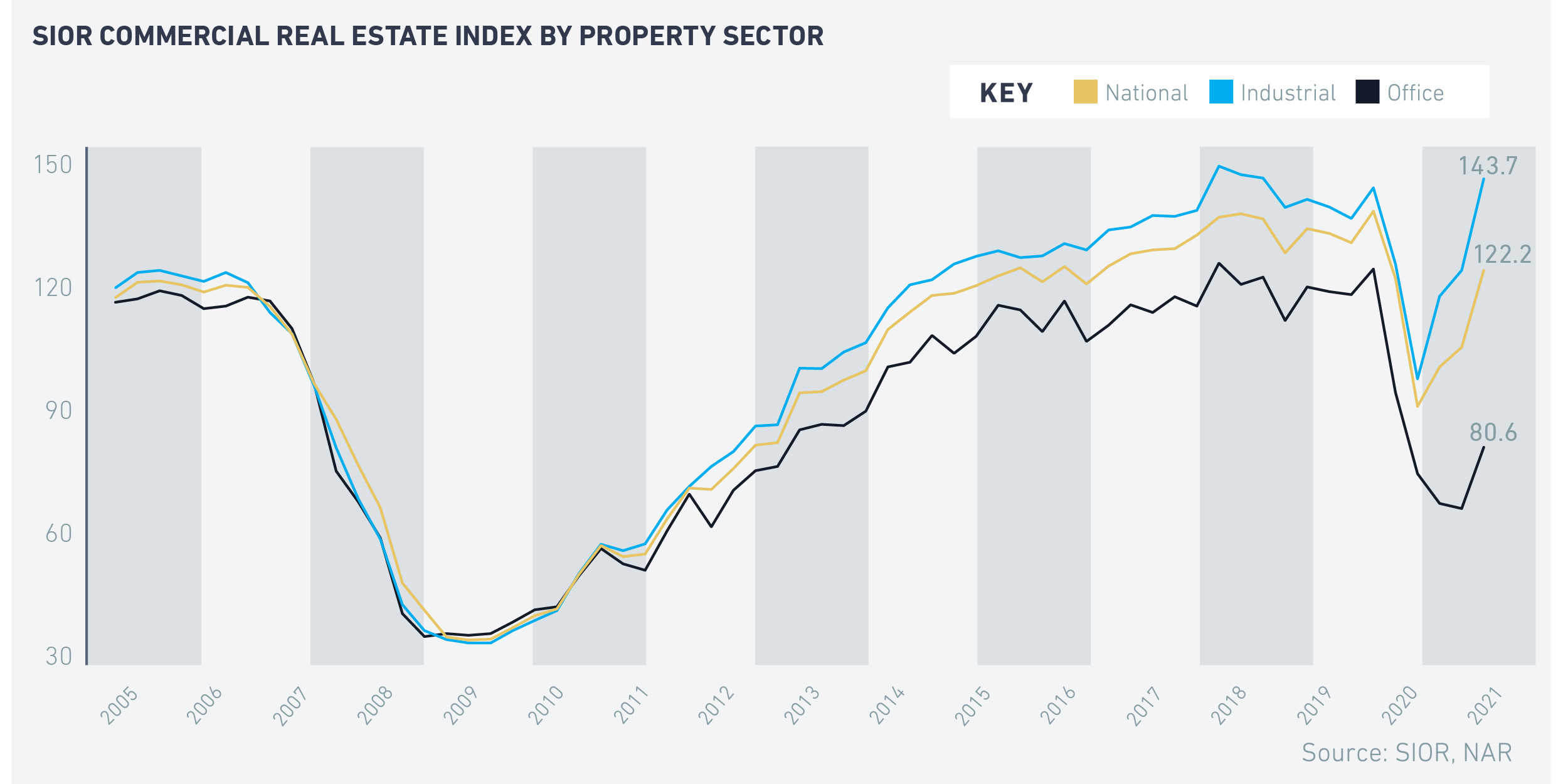

The office and industrial commercial real estate market conditions improved in the first quarter of 2021 compared to the prior quarter and one year ago, according to SIOR members who participated in SIOR’s quarterly survey.1 The survey gathers indicators on sales, leasing, development activity, and national and local economic conditions that are the aggregated into an index. An index above 100 indicates that market conditions are positive, whereas below 100 indicates conditions are negative.

In the first quarter of 2021, the SIOR Commercial Real Estate Index rose to 122.2, up 17% from the prior quarter and 2% from one year ago. Respondents reported that industrial real estate market conditions were broadly positive, with the SIOR Industrial Index rising to 143.7, an increase of 18% from the prior quarter and 16% from one year ago. Respondents also reported an improvement in office market conditions, but overall conditions remain negative (index is less than 100). The SIOR Office Index rose to 80.6, up 22% from the prior quarter, but it is still 14% below the level one year ago.

Other data sources on sales, vacancy, and leasing corroborate the results of this survey.

According to Real Capital Analytics, office CRE sales transactions of $2.5 million or over during the first two months of 2021 totaled just $3.1 billion, or 56% below the level one year ago.2 Another 41 million square feet of office space became unoccupied in the first quarter of 2021, resulting in total negative net absorption of 138.4 million since the pandemic began. Cushman and Wakefield reports that office vacancy rate shot up to 16.4% from just 13%.3

In the industrial commercial real estate market, occupancy has increased by 310 million square feet since the pandemic started. As of the first quarter, the vacancy rate averaged 4.9%, slightly below the 5.1% vacancy rate from one year ago. The industrial property has remained the most resilient and robust market during this pandemic, bolstered by the acceleration of online shopping.

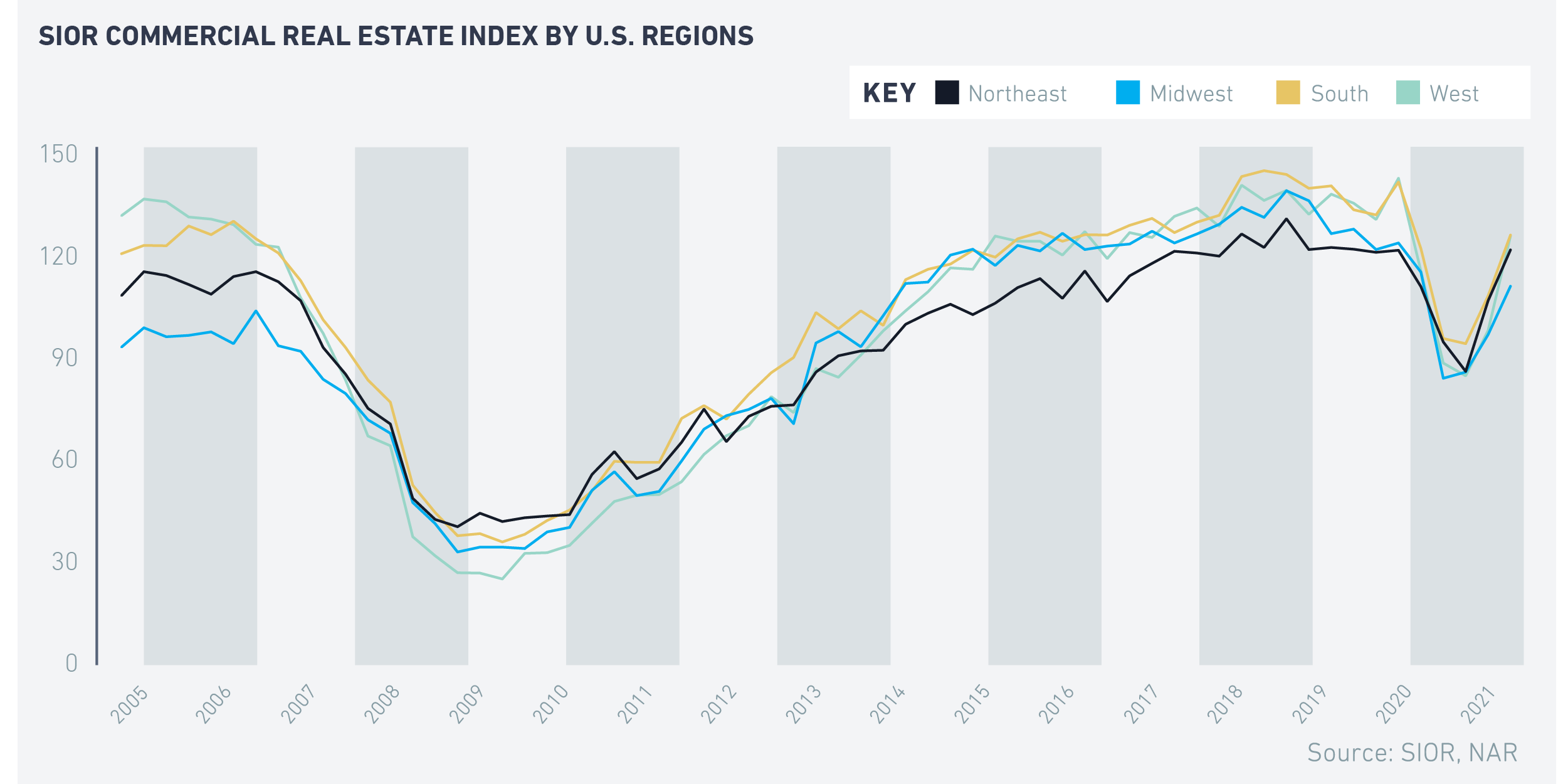

The indices for all the regions all increased, indicating that the recovery is broad-base. All indices are higher than one year ago, except for the Midwest.

Leasing activity is also picking up, with 65% of respondents reporting that it increased in the first quarter of 2021 compared to one year ago.

Rents are also holding up, with 55% of respondents reporting higher rents compared to one year ago.

Respondents reported vacancy rates to be easing, with 51% of the respondents reporting that vacancy rates are lower than one year ago.

Respondents are optimistic about the commercial real estate prospects in the coming quarter, with 61% reporting a positive outlook.

| Key Results of the 2021 Q1 SIOR Survey on Industrial and Office Market Conditions - 65% of respondents reported that leasing activity was higher compared to one year ago (28% in 2020 Q4).

- 55% of respondents reported an increase in asking rents from one year ago (38% in 2020 Q4).

- 51% of respondents reported lower vacancy rates compared to one year ago (43% in 2020 Q4).

- 35% of respondents reported adequate to extensive subleasing availability (35% in 2020 Q4).

- 31% of respondents reported tenant concessions were favorable to tenants (40% in 2020 Q4).

- 53% of respondents reported development activity is above average (43% in 2020 Q4).

- 65% of respondents reported site acquisition costs are favorable for sellers (48% in 2020 Q4).

- 51% of respondents reported investment pricing conditions are above replacement cost (44% in 2020 Q4).

- 62% of respondents reported local economic conditions have a positive effect on the market’s performance (43% in 2020 Q4).

- 58% of respondents reported national economic conditions have a positive effect on the market’s performance (38% in 2020 Q4).

|

1-235 respondents

2-Real Capital Analytics

3-Cushman and Wakefield