In Slovenia and its capital city, Ljubljana, where—as elsewhere in Central and Eastern Europe (CEE)—the industrial and warehouse markets have seen great momentum, there is a crossroads of some major corridors: “X - Pan-European,” “Mediterranean,” and “Baltic-Adriatic”. This integral part of the logistics arena has ensured that the area has made an impact on the industry across the globe.

To start, here are a few facts about Slovenia:

- It is a small country in CEE on three major cross-corridors across Continental Europe.

- It has the biggest port (Port Koper) in the region.

- Logistics activity is vibrant.

- There is currently a lack of new warehouses, despite increasing demand.

As elsewhere in Europe, the situation in the industrial and logistics real estate segment in Slovenia can be summarized as growing demand with a lack of supply due to scarcity of appropriate greenfield development opportunities. This results in higher land prices, particularly in the vicinity of Ljubljana.

Logistics corridors over Slovenia

Logistics corridors over Slovenia

Source: www.investslovenia.org

FOCUS ON DEMAND IN LJUBLJANA

Greenfield land prices in and around Ljubljana have risen from €120 to €250+ per sq.m. over the past three years (which is greater than 30% year-over-year) while the rental prices went up by less than 10% per year over the same period (over €6 per sq.m. per month in 2022).

Based on our experience and recent transactions, in 2022, smaller units of up to 2,000 sq.m. (21,520 sq. ft.) have reached rental prices of up to €8 per sq.m. per month. This level of rent still does not necessarily meet the return on investment for industrial developers.

EXPANDING OUTSIDE THE CAPITAL

Scarcity of land availability and rising prices are forcing developers to build outside of the capital, next to the highway junctions of other major towns such as Maribor and Celje, and industrial zones like Logatec, Sezana, and Novo mesto, all of which have good connections to Ljubljana and Port Koper.

DEMAND AT NATIONAL LEVEL IS CONFIRMED

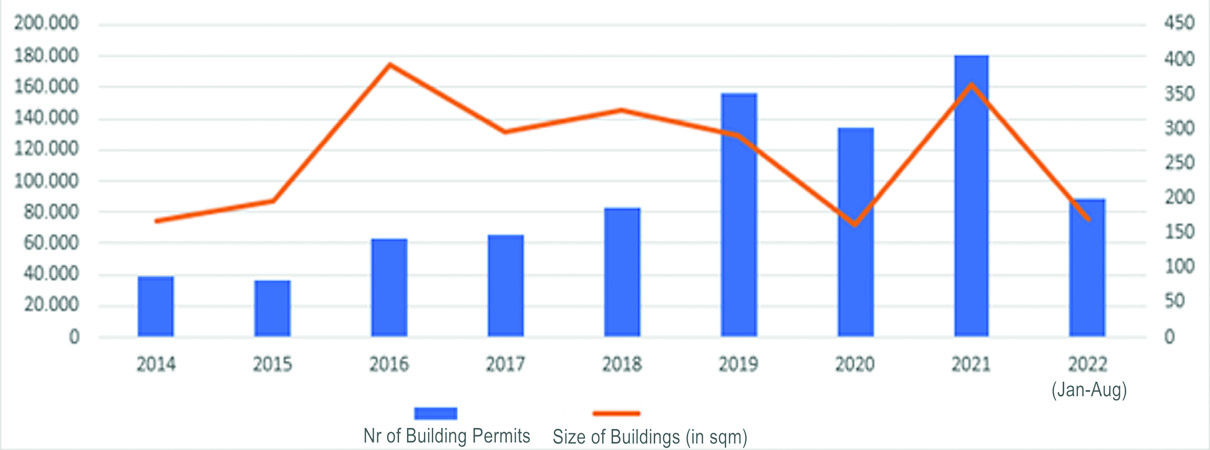

This higher demand is leading to a market that shows a rising trend in building permit approvals, which is usually translated into construction. Although the figures for 2022 are not yet finalized, it is expected that the number of building permits and the cumulative capacity (size of warehouses in square meters) will remain similar to the previous year. Based on high demand, there may be much more industrial constructions should more affordable land be available.

Authorized building permits for warehouses in Solvenia, period 2014-2022

Authorized building permits for warehouses in Solvenia, period 2014-2022

Source: Statistic Bureau Sloevnia, Reconsult & partners, Sept 2022

ORIGINAL INVESTORS WERE OWNER-OCCUPIERS

It is interesting to note that until recently, mainly owner-occupiers have been investing in Slovenia, building warehouses for their own needs instead of investors building to step into the value chain. An example of this would be international retail company Lidl, which established a self-distribution logistics center near Celje (approximately 60,000 sq.m./645,600 sq. ft,).

However, the first major warehouse development occurred in 2018 by logistics company Kuehne & Nagel, and was the largest custom built warehouse in Europe for international pharmaceutical company Novartis (approximately 40,000 sq.m./430,400 sq. ft.).

SHIFT TO SPECULATIVE DEVELOPMENT INVESTORS

In parallel, private domestic and foreign investors have been appearing to fill the gap with fresh warehouse development for tenants. There is high demand for long-term leases for spaces up to 2,000 sq.m. (21,520 sq. ft.) as well as noticeable interest for larger units of multiples of 10,000 sq.m. (107,600 sq. ft.) Based on experience, larger warehouses were—on average—leased out in six months from when construction started, while tenants for smaller units (up to 2,000 sq.m./21,520 sq. ft.) are still waiting in line due to shortage of adequate supply.

DEVELOPERS ARE SHAPING SUPPLY

One of the biggest Austrian-Slovak logistics developers foresaw the opportunity to develop a warehouse larger than 30,000 sq.m. (322,800 sq. ft.) in Maribor and has another warehouse of more than 120,000 sq.m. (1,291,200 sq. ft.) under development close to the border of Italy. Following this trend, some other domestic and foreign developers are stepping into the value chain and are planning to develop warehouses in Ljubljana along with a few other towns in major industrial areas along the transport routes. Project sizes range from 20,000-40,000 sq.m. (215,200-430,400 sq. ft.).

Based, however, on market research, personal experience, past transactions, and tenant/owner-occupiers’ waiting lists, there is demand for 500,000 sq.m. (5,380,000 sq. ft.) of modern warehouse capacity. In addition to the previously mentioned demand, this number also takes into account the fact that some major Slovenian companies are in huge need of consolidation of their logistics activities, relating to a warehouse/logistics center of at least 40,000 sq.m. (430,400 sq. ft.) per company.

CONCLUSION

The analysis of major global real estate agencies as well as information from our cooperation with domestic/foreign investors and real estate developers has shown that medium- and long-term demand for storage capacity will remain at high levels. Global geo-political issues, the economic situation, and the constant increase in e-commerce is creating higher demand and spurring the reorganization of supply chains in order to ensure more storage capacities in Europe as well as in Slovenia.

Slovenia is a good opportunity for industrial and logistics development, as current and foreseeable trends in the warehouse segment are pushing for newer facilities and rises in rental prices.