Right on So Many Levels

THE EVOLUTION OF MULTI-STORY WAREHOUSINGThe multi-story warehouse concept is well established in a number of major Asian cities—including Hong Kong, Singapore, and Tokyo—where high population densities have exerted strong pressure on land values.

Rapid growth in "last mile" delivery requirements means rising demand for urban warehousing across the globe. With urban space at a premium, multi-story warehousing is gaining traction in some major centres across North America and Europe.

In the UK, there are many examples of very high single-story warehouses with mezzanine floors, but despite a number of proposed schemes in recent years, only one "true" multi-story scheme has been developed to date: 234,000 square foot X2 at Heathrow, developed by Brixton / SEGRO.

Against this backdrop, we examine the prospects for the multi-story concept in London.

WHY IS DEMAND FOR 'LAST MILE' SPACE INCREASING SO RAPIDLY?In London, occupier demand for last mile logistics has been accelerating due to a potent combination of:

- Rapid growth in e-commerce and direct delivery to consumers – the value of UK internet retail sales now accounts for more than 18% of total retail sales and—on its current trajectory—could represent over 30% of sales in five years’ time.

- Rising consumer expectations – not only are consumers buying more online, but they are also demanding an increasingly rapid and efficient delivery service.

- Population growth – Greater London’s population is projected to grow by 7.7% over the next decade. As London can’t expand outwards due to planning and geographic constraints, this inevitably means a rising population density.

- Sustainability – London’s Congestion Charge—a daily charge for driving a vehicle into the city centre—has been followed by the Ultra Low Emission Zone—an additional charge for vehicles that don’t meet emissions standards. Regulation is likely to become progressively more restrictive.

- The rising popularity of city centre living and strong employment growth means more deliveries are required in central London.

THE SUPPLY CHALLENGEThe increase in demand for last mile distribution space is set against a highly challenging supply picture. London’s industrial land supply is in long-term decline, and given the city’s structural housing shortage plus continued rapid population growth, pressures will become ever more acute.

Rapid growth in ‘last mile’ delivery requirements means rising demand for urban warehousing across the globe.

The constrained nature of London—it is surrounded by the Green Belt, which severely restricts development—points towards the need to do more with less space, and planning policy is responding with an increased focus on intensification. For the warehousing sector, this points towards building higher—or underground; increasing the level of site coverage; and providing more industrial within mixed-use schemes.

Severe supply pressures have resulted in strong rental and land value growth in recent years. Over the last two years prime rental values in London and the inner South East have risen by nearly 9% and land values have increased by more than a third. Assuming that rental growth continues to be above general inflation and building costs, the viability of multi-story development should improve.

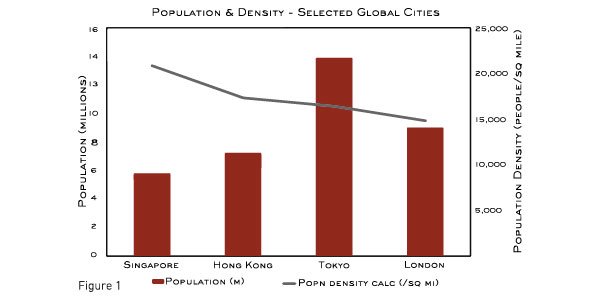

HOW DOES LONDON COMPARE WITH ESTABLISHED MULTI-STORY MARKETS?We have compared London’s population and prime rents with the successful Asian multi-story industrial markets of Singapore, Hong Kong, and Tokyo.

Although Greater London has a lower population density than all of these markets, at nearly 15,000 people per square mile, it is not that far behind Tokyo (16,400). Greater London’s total population of 9 million makes it 1.5 times larger than Singapore, and 1.25 times Hong Kong, although only two thirds the size of Tokyo. Overall, this suggests that London’s size and density are not too dissimilar to these successful multi-story markets (see Figure 1).

In addition, industrial rents in prime areas of London are higher than those in Singapore and Tokyo, and only a little way behind Hong Kong—although care needs to be taken in comparing rents without taking into account other occupancy costs, especially the UK’s very high level of Business Rates. This suggests that cost pressures are also broadly comparable (see Figure 2).

GOOD IN THEORY - SO WHAT ARE THE BARRIERS?The fundamentals appear to support multi-story warehousing in London, but there are some key differences to comparable markets in Asia. Occupational taxes are considerably higher in the UK than most other global markets—Business Rates can be 40-50% of rent, compared with typically 3-5% in many global markets; London’s constrained road layouts could render many sites unsuitable for the necessary volume of lorry traffic; and smaller trucks in some Asian markets make for easier vehicle access to upper levels.

Multi-story industrial is nascent in the UK, and market norms need to develop across issues ranging from how to price rents on different floors, to valuation principles. SEGRO’s X2 scheme took many years to fully let, and although this was largely down to its launch in 2008 at the start of the recession, it has perhaps created the wrong impression.

However, the key question is whether occupiers are prepared to pay sufficient extra rental and other occupancy charges to cover the additional build and operational costs of multi-story. We think that as the commercial pressures on last mile delivery increase, the opportunity cost of not being located in the right space will rise, increasing the level of rent that occupiers are prepared to pay.

CONCLUSIONS - DOES MULTI-STORY IN LONDON STACK-UPThe rapid growth in e-commerce is driving demand for urban logistics across the globe. In London, high population density, strong economic and population growth, rising city centre living, and regulation on vehicle usage are all further fueling this demand.

Given the constrained geography of London and a long-term housing shortage, this growth is increasing the pressure on land supply, resulting in strong rental and land value growth. Planning policy is responding with a greater focus on intensification.

All of this points towards multi-story warehousing as part of the solution, but this will only happen if the concept works for the market in terms of both design and viability. Currently, many developers appear to view it as simply too risky.

As consumer expectations rise and land supply becomes increasingly constrained, retailers and their logistics partners should be prepared to pay higher rents in order to be located in large, efficient last-mile distribution facilities close to their customers.

If this becomes sufficient to cover the higher construction and running costs, we believe there is considerable potential for the multi-story concept to build momentum, establish market "norms," and perhaps become a feature of London’s commercial property market. However, it may need some pioneers who are prepared to prove that the concept works.