As a result of the COVID-19 pandemic, online shopping has grown at an exponential rate across the world, and Poland has been no different. The share of e-commerce in retail trade more than doubled between February and April 2020 in Poland, rising from 5.6% to 11.9%. What we expected to take place over the course of several years happened in just a few months.

As nervousness related to the virus subsided in Poland and infection levels have dropped down, people have gone back to bars, restaurants, offices, and stores. But the mental barrier about shopping online has come down for many people. Indeed, according to Accenture's Fashion Business, 20% of Poles tried online retail for the first time in their life during the pandemic, and a lot of them realized that it can be both convenient and time-saving. The pandemic has likely permanently turned a large number of shoppers into e-shoppers.

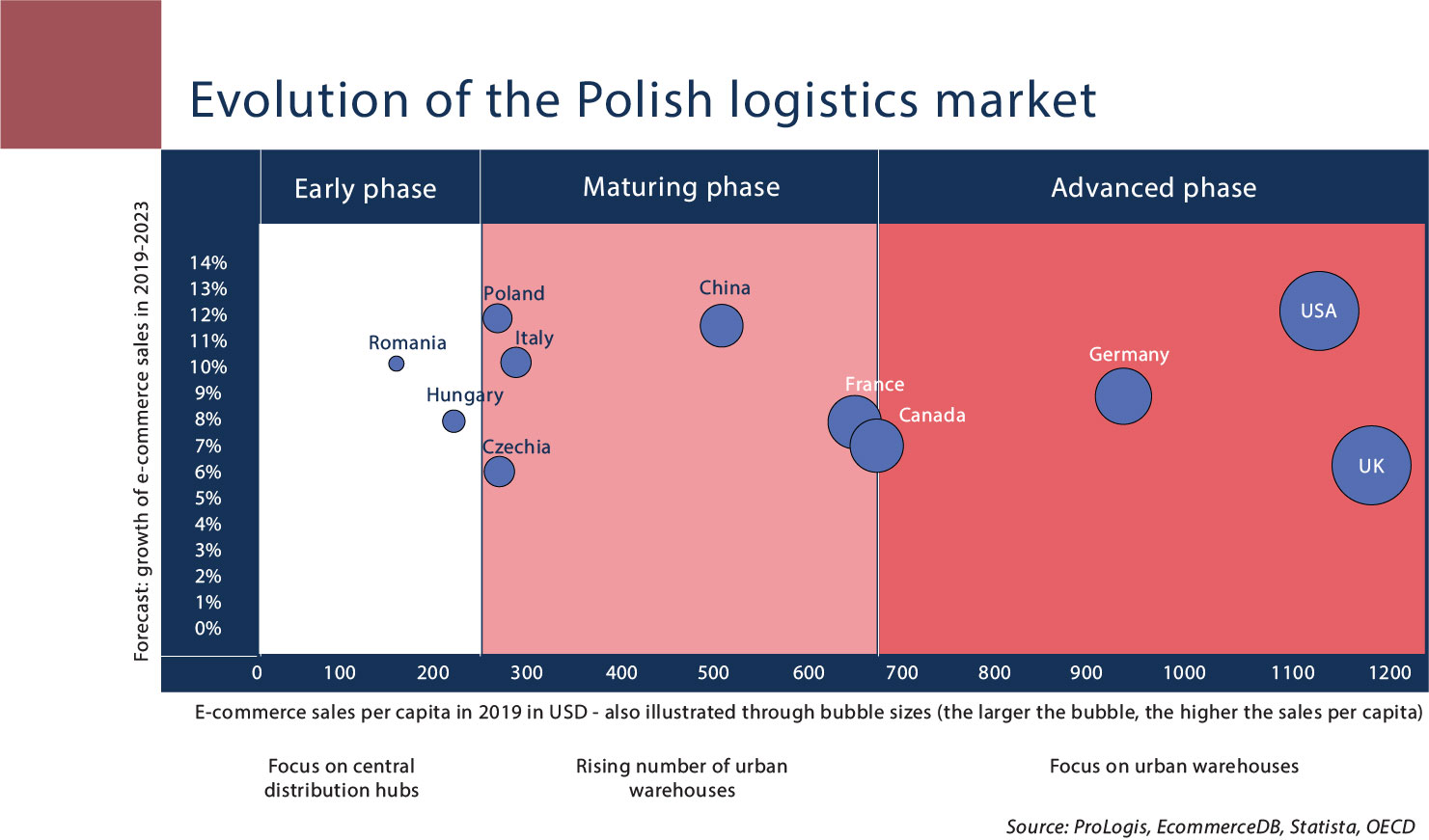

The unprecedented jump in e-commerce has turned the attention of retailers, logistics firms, and couriers to urban logistics real estate as they have sought ways to effectively handle rapidly growing online orders. It fast-tracked the country’s transition to a more mature logistics market, more akin to the U.K. or U.S. where e-commerce penetration is much higher.

Although still behind these two leading e-commerce markets, Poland has come a long way—just several years ago, infant e-commerce trade was served almost exclusively by central warehouses in decentralized logistics hubs such as Stryków in Central Poland. From there, orders were delivered within several days to end-consumers in various parts of the country. Some markets in Eastern Europe are still at this stage of development—for example Romania, as shown on the chart on page 24.

As demand for e-commerce has grown and consumers have increasingly expected ever-faster deliveries, urban warehouses serving the largest agglomerations have mushroomed. Take-up in urban projects more than doubled in 2018 (up from approximately 240,000 square meters in 2017 to approximately 460,000 square meters) and then increased by a further 30% in 2019, to approximately 600,000 square meters. Supply has increased in response and we currently estimate the share of urban logistics projects in total warehouse stock at 11%. In addition, urban projects account for more than 14% of total warehouse space currently under construction.

Maturity of logistics markets across the world:

Maturity of logistics markets across the world:

This chart maps selected countries in terms of their expected e-commerce growth (forecast for 2019-23) and the current maturity of its e-commerce sector (e-commerce sales per capita). The higher the dot representing the country, the faster the expected e-commerce growth. The larger the dot and the further right it is positioned, the higher the current penetration of e-commerce.Large regional and national distribution centres remain important elements of the Polish supply chain and they are still able to handle a large volume of online orders. They enable deliveries to most parts of the country within a relatively short space of time. For example, a lorry in Stryków can reach almost any place in Poland within three to four hours. In addition, such hubs offer relatively low occupation costs. But with the same day delivery becoming more common and a next hour delivery likely to emerge in due course, urban logistics will be the fastest growing segment of the market.

Already, according to a recent Gemius survey, 62% of Poles expect their parcel to be delivered within 24 hours. Online consumers will be seeking the speed and convenience that was in the past satisfied only by high street shops. A larger number of urban facilities will be needed to respond to these rising expectations. More and more online retailers and logisticians will consider it necessary to ship goods from their central warehouses to urban facilities first, before delivering them to end-consumers, in order to be able to offer the shortest possible delivery time.

Additionally, concerns about pollution will increasingly lead to heavy restrictions on entry of motor vehicles into city centers. There may be no choice but to locate closer to urban areas, with the last leg of the journey conducted in an electric vehicle, scooter, or even cargo bike.

Finally, proximity to end-consumers enables more deliveries per day—and in the low-margin logistics business, this counts for a lot. All these factors will attract logistics companies to warehouses on the edges of cities.

The evolution of the Polish supply chain is illustrative of the impact e-commerce has exerted on the physical infrastructure in countries all over the world. Our observations from the last few months are also in line with experiences shared by our clients, colleagues and business partners based abroad.

Two things are certain: that no country will escape the e-commerce revolution and that the pandemic will fast-track the changes that have already commenced. There are two types of innovations: those that happen much later than we expect or never happen at all—such as the Back to the Future hover boards and Jetsons’ jets—and those that quietly creep into everyone’s lives and change almost all their aspects within a matter of years—such as smart phones. E-commerce seems to be in the second category.