As we enter a new decade, technology and medicine continue to improve the lives and life expectancies in the U.S. Recently, the CDC reported that life expectancy has increased for the first time in four years. Our aging population is only growing, and they are sticking around for longer. So, what does this mean for the healthcare industry?

The healthcare industry is an enormous economic force, representing nearly 18% of GNP in the U.S.1 With over 20 million Americans working in the sector, it is the nation’s largest and fastest-growing employer.2

This sector is fueled by generational population demographics with the “Baby Boomer” group historically being the largest. It is projected that the number of people in this age group (over 65 years) will more than double by 2050 (88.5 million) from 2010 (40.2 million).3 The Global Health and Aging Report predicts worldwide growth for this aging group to increase to 1.5 billion in 2050 from 524 million in 2010.

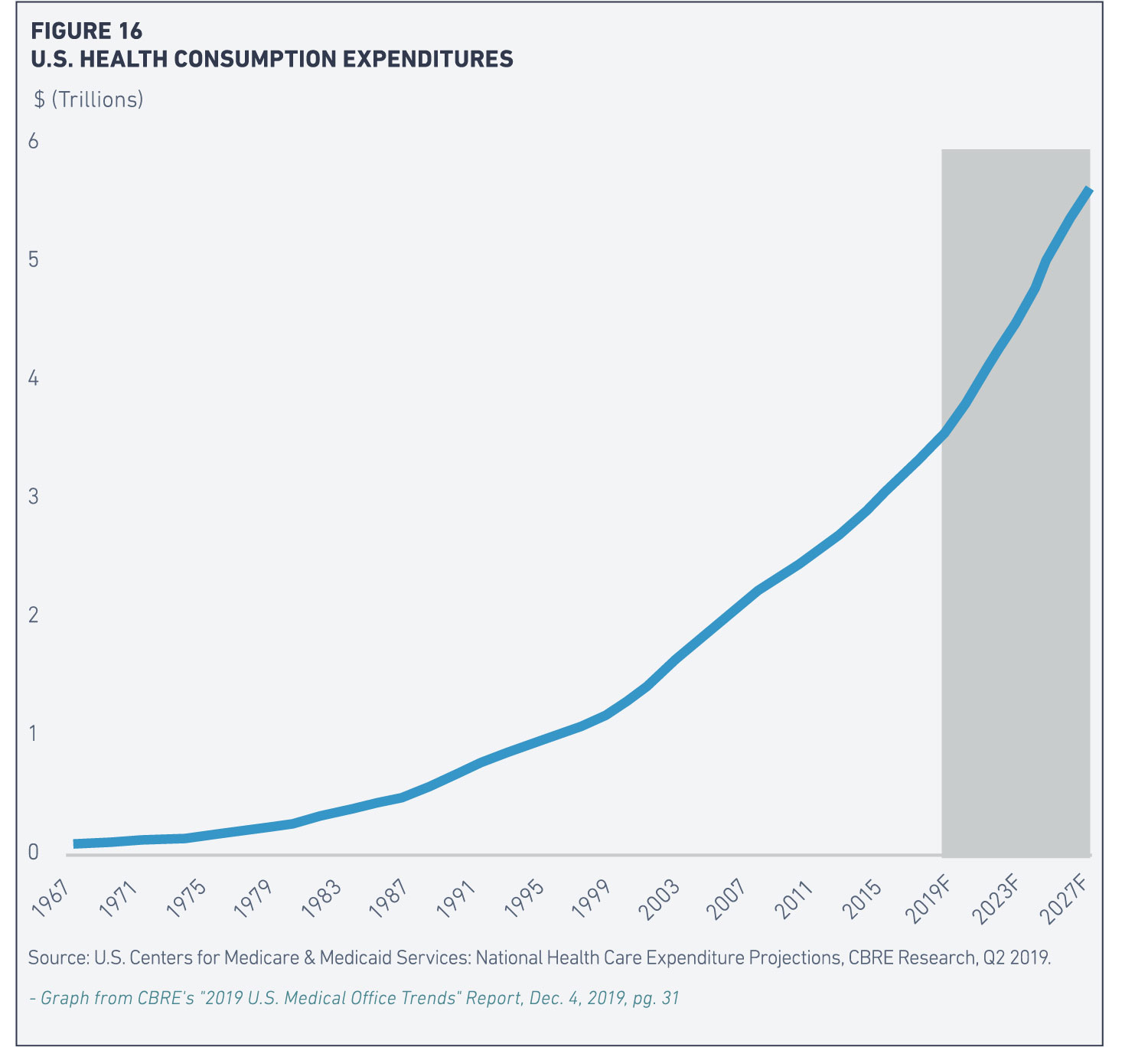

The aging population will continue to challenge healthcare providers’ revenue models based on the current reimbursement criteria of value-based care and patient satisfaction, while still needing to provide quality care at a lower price point. This has made it difficult for the healthcare industry to generate sufficient financial margins to survive. They are charged with improving quality of care—that generally leads to added resources—while also reducing cost at a time when they are experiencing reduced reimbursements from government programs, insurers, and the individual consumer. Healthcare costs also continue to rise at an unsustainable rate.

An aging patient base places enormous pressure on the healthcare system, with considerations such as:

- Baby Boomers disproportionately utilize healthcare services and the usage rate increases exponentially with age.

- Consumer demands for more flexibility, convenience, and better cost transparency.

- Increasing patient volume will stress the current physician shortage.

- Older patients often have multiple chronic conditions which are difficult to manage and require a multi-disciplinary approach. Some of the top chronic conditions include dementia, cancer, increase in falls, obesity, and diabetes4

- Added resources for telemedicine, virtual health, home-based care, and preventative and wellness care

- The level of disability and mobility of older patients requires significant real estate capital expenditure to add new locations closer to the patient

- The consolidation of health systems, insurers, and physician practices will continue as they seek better market coverage and expanding their services in an effort to reduce overall costs.

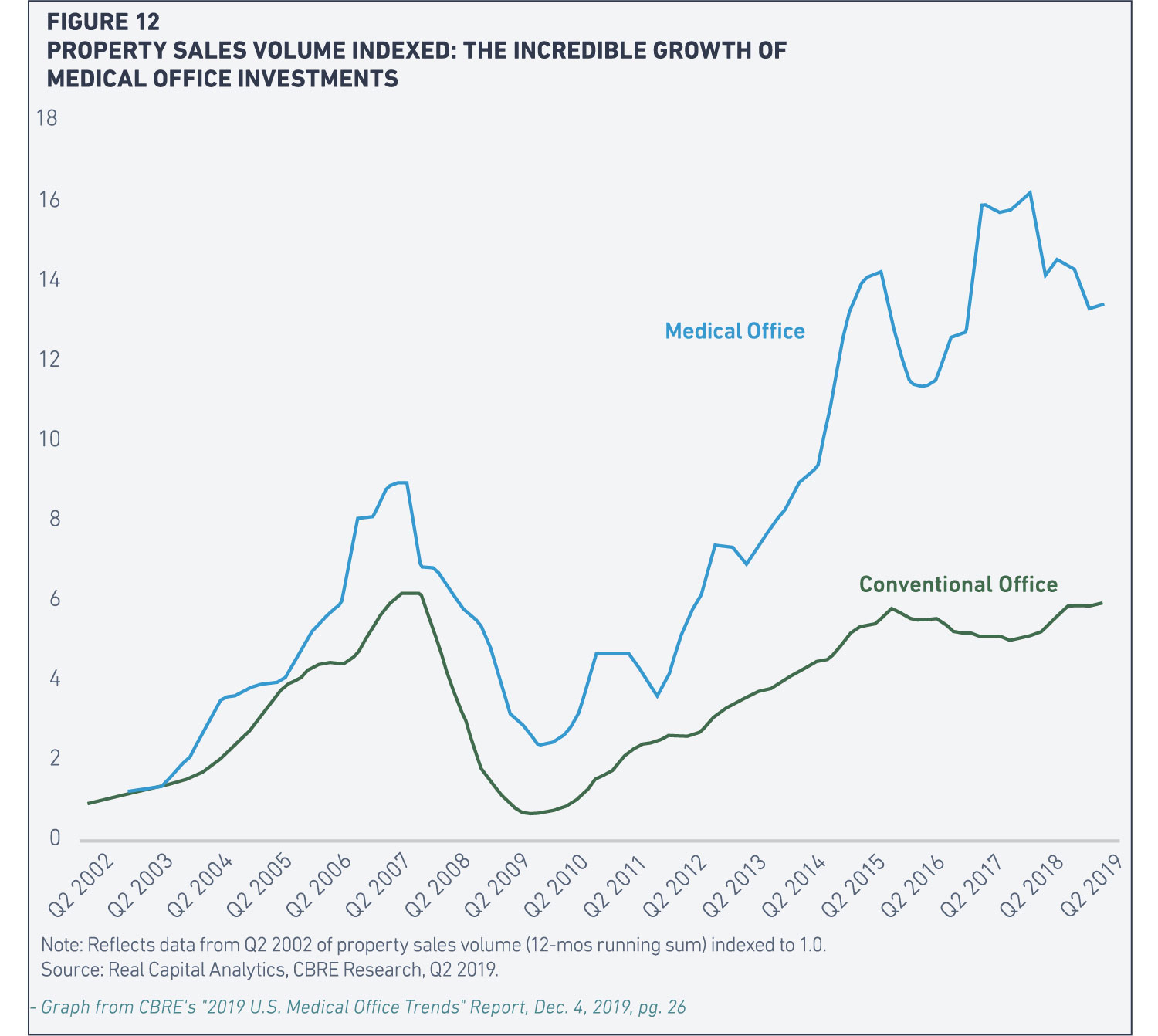

The aging populations’ pressure on healthcare providers has created a fundamentally solid, stable, and expanding medical office real estate market. These new real estate opportunities include convenient locations that allow for visible branding, easy access, ample parking, a pleasing clinic design, and the ability to locate primary care with complementary services, including pharmacy, surgery, imaging, as well as urgent and specialty care.

Technology is a major driver that has allowed many procedures to be done in an off-campus location at a lower cost than in a hospital. New clinic locations across the country have included backfilling well located vacant retail sites, new freestanding urgency centers, new ambulatory surgery centers (ASC), and full-service medical office buildings that include the complementary services mentioned above. These are “one-stop” facilities located near strong retail services close to a sizeable patient population.

Developers and owners of medical office buildings have necessitated being creative in completing transactions with healthcare providers due to their lack of capital for real estate projects. They are doing so by providing turn-key clinic build-outs in exchange for a longer term lease, or amortizing excess tenant improvement allowances into the base lease rate over the lease term, as well as assisting with moving costs or rent abatement. This may not be as desirable for developers, but they can work with providers on shorter-term leases, so they don’t have to capitalize them and can also assist in quicker lease approvals with large hospital systems. Creative structures to repurpose underutilized facilities or consolidations can create overall efficiencies and long-term cost savings. Real estate providers that can partner with their healthcare clients can assist in implementing a long term strategic real estate plan that can effectively support their business objectives and care delivery goals.

Based on healthcare industry trends and consumer pressures, the current medical office real estate market is thriving. The medical hospital and office building sector are currently valued at $1 trillion with 122 million square feet under construction, valued at $17.2 billion.5 Strong market fundamentals stoke investor demand that suggest a low recession probability for medical office. Medical office building sales have surpassed $10 billion again in 2019 with historic low cap rates averaging 6.4%.5 Medical office building investments offer long term leases with annual base rent increases and generally long-standing practices that pay rent timely. The biggest issue is that investor demand continues to outpace adequate supply. Interest rates have remained low, which has balanced higher development costs and acquiring at competitive low cap rates.

Healthcare industry providers will continue to struggle with escalating healthcare costs, an aging demographic, reimbursement uncertainties, and an ever- changing regulatory environment. These forces will require careful, creative strategies in an effort to maintain growth within the industry. This continuously changing landscape that challenges healthcare providers will continue to create opportunities for the medical office real estate sector. Demographic and industry trends are firmly established and predicted to persist—which supports long-term demand for medical office leasing, investment and development.

1-revista, The MOB Scene – November 26, 2019

2-Connect Real Estate News – Healthcare – December 5, 2019

3-United States Census Bureau

4-The Aging Population: The Increasing Effects on Healthcare – Anyssa Garza, PharmD – January 2016

5-revista – Q3 2019