The door locked, and we heard the clock start ticking. My family and I embarked upon our first Escape Room experience. Our team consisted of seven adults and Bo, my eight-year-old nephew. Bo is an All-American boy who loves sports, video games, running, jumping, and is always on the hunt for the next new adventure. The challenge was to use our wits to uncover clue after clue in succession, leading us to the key that would unlock the door to our freedom, but we only had one hour to escape.

With an average age of 40, the adults in the room—as you might expect—began looking around analytically and thinking logically about where we should start. Meanwhile, Bo began picking up objects with immediate excitement, “Here’s a clue!” But it wasn’t. Then again—and again, and again. Still no clues for Bo. And we adults, in all our “infinite wisdom” patted Bo on the head as his excitement seemed to have no end. We glanced at one another as if to say, “How cute is Bo! He keeps looking for clues in places that aren’t rational.” We thought that until Bo found the first clue.

We cheered, “How about that! Of all of us, the child found the first clue. Life is sprinkled with luck, isn’t it?” Just after that, Bo found the next clue, and then the next. At this point, the adults moved from glancing at each other to scratching our heads while Bo went from clue to clue until he found them all. He claimed the key that unlocked the door and led all of us to our freedom. Bo had a gift the adults didn’t: he had no predetermined boundaries that stopped him from moving from one idea to the next. For the rest of us, walls that blocked creativity and discovery had been built up through the years. These same walls can block creativity and discovery when it comes to investing in commercial real estate.

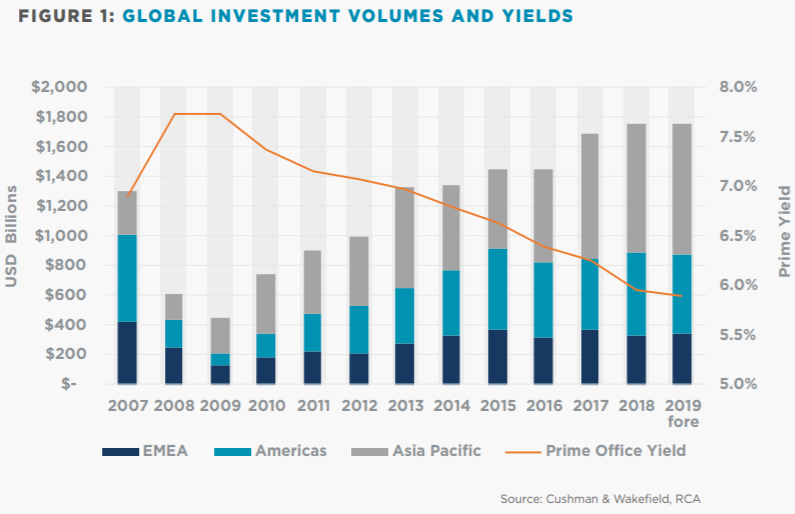

ASSUME A DEAL EXISTS For much of the last decade, an abundance of capital has been available from both debt and equity perspectives. The consequence of a larger pool of investors with a larger pool of capital is an increased challenge to find a “deal” as evidenced by the chart in Figure 1. When looking for the next investment opportunity, it is easier to stay on the surface of the deal and find a challenge or two before crossing it off and then moving onto the next potential opportunity. After doing that a few times, the single-tenant, net-leased, 15-year term, miniscule cap rate begins to look more attractive. As commercial real estate investors or brokers, we can be wired to think with the left side of our brains—logical, analytical, and linear. The left-brain dominance works well in the CRE industry, but it can be a double-edge sword that prevents us from diving below the surface of a deal.

Source: Cushman & Wakefield, RCA

What if investors assumed a deal existed on each opportunity? Would that change the way the first obstacle is approached? My investment team began by brainstorming a list of investment opportunities, then proceeded to underwrite each opportunity one-by-one. At the first obstacle on each deal, we assumed there was no deal to be had, so we moved to the next. After the last deal on the list, we looked at each other with nothing else to do. It wasn’t until we channeled our inner-Bo—our inner-child—and implemented right-brain thinking—imagination, intuition, and artistry—that we gained traction.

"For the rest of us, walls that blocked creativity & discovery had been built up through the years."

For example, the property owner—a dentist—wouldn’t sell because his dental practice was the sole tenant. The location and property worked well for his business. Instead of moving on, we called the adjacent property owner who had an appetite for selling. What if we combined the properties, partnered with the dentist for his property as his equity, and built a mixed-use property that included his dental practice and a dinner restaurant on the first floor along with multi-family units on the second floor? It could be worth exploring.

CONNECT THE DOTSIn his book, The Proximity Principle, author Ken Coleman describes that principal as the ability to “find opportunities to do what you love by getting around the right people and being in the right places.” Children like Bo do this intuitively on the playground, but adults must intentionally engage this part of their brains to use it for their benefit. In commercial real estate, one recipe for investor success is how many dots of data and people are in your network and—more importantly—how well you connect those dots. When looking for investment deals, it is imperative to gather data and talk to people. Through the process, an investor will find patterns as it relates to tenants, space needs, locations, etc. It is that data and those people that reveal key insight as to which deal to buy.

For example, an infill property of one acre with a dilapidated vacant home has very little value as an investment. The neighboring property is a one-million square foot manufacturing plant for ABC Company. If an investor discovers that ABC Company can decrease cost by cutting transit time if one of the company’s key vendors are located adjacent to the plant, then the one-acre site becomes significantly more valuable. Regardless of the asset class or size of deal, investors can make decisions based on market intel available to everyone, but the significant increase in investment performance comes by gathering the more hidden intel through consistent communication with key people.

WORK THE NUMBERSFor most people, CRE financial underwriting spreadsheets are only useful as a sleep enhancement. For CRE investors, financial underwriting should act as a puzzle. How can each piece of the puzzle fit together to form a unified tapestry, a beautiful tapestry of 25% cash-on-cash return!—or whatever investment goal is set to be accomplished? Each line item in the financial underwriting should be assumed, then questioned, and then flexed in multiple directions to test sensitivity on the outcome. Any successful investor will stress the importance of staying disciplined to an investment model with little deviation. At the same time, the model shouldn’t be void of innovation. A fine line exists between a disciplined investment model and creativity. It is the investor who can most effectively walk that line that will reap the largest rewards of success.

In a poll of more than 1,500 CEO’s performed by IBM , the number one factor for future success was: Creativity. Isaac Newton said, “We build too many walls and not enough bridges.” That statement rings loudly true when it comes to investing in commercial real estate. In discipline and good practice, investors wisely develop investment boxes to prevent them from chasing rabbits down profitless holes. Those same investment parameters can sometimes block the road to successful investing. We must remain disciplined while also allowing room for creative investing.

Be like Bo. Break down the walls that block creativity.